CIO's Letter: H1 2025 Market Insights

7 July 2025

Sign up to our newsletter for regular insights from the Hundle team.

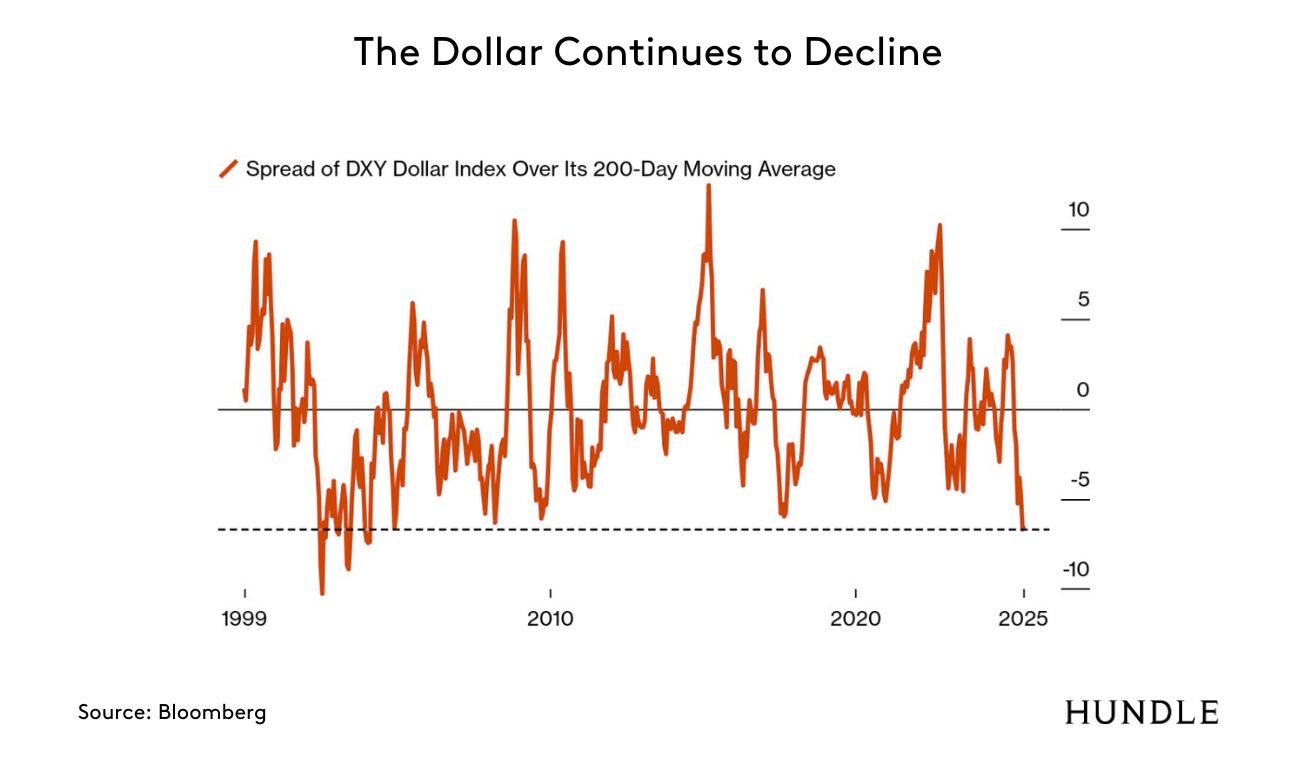

The first half of 2025 has served up a market narrative thick with contradictions. The US dollar has weakened to levels not seen since the 1970s, equities have swung from sharp sell-offs to sharp recoveries, and risk sentiment has oscillated between panic and euphoria. Through it all, one truth endures: in an increasingly unstable world, the challenge for investors is not just return, but resilience.

Our investment approach remains grounded in that principle. In this update, we examine the key themes from H1 and how we’re positioning client portfolios for the second half of the year.

THE DOLLAR STUMBLES

Let’s start with the most visible shift: the US dollar. So far this year, the ICE Dollar Index has fallen more than 10% – its worst first-half performance since the collapse of the Bretton Woods system in 1973.

This isn’t just currency volatility. It’s a referendum on American credibility. Trump’s “Liberation Day” tariffs, a ballooning fiscal deficit (expected to rise by $3.2 trillion under his tax plan), and growing concerns about Federal Reserve independence have all undermined the dollar’s safe-haven status.

Contrary to earlier expectations that protectionist US policies would hurt foreign economies more than America’s, capital has moved the other way. The euro is up 13% this year. Demand for US Treasuries has faltered. Foreign investors are hedging – not just their currency exposure, but their confidence in Washington itself.

MARKET REBOUND: DON’T BE FOOLED

Yes, the S&P 500 has reached a new all-time high in dollar terms. But the path here has been anything but smooth.

Markets saw a significant sell-off earlier this year as investors digested the implications of Trump’s tariff escalation. Wall Street strategists cut year-end forecasts in a panic – only to scramble higher again as the administration signalled it might delay the most extreme measures.

What’s propping up the rally isn’t fundamentals. It’s hope. Hope that tariffs won’t damage margins, that tax cuts will offset economic headwinds, and that the Fed will pivot dovish under political pressure. Valuations tell a different story: the S&P is trading at more than 3x sales, with earnings yields now below 10-year Treasury yields – an inversion that offers little compensation for taking equity risk.

WHY WE REMAIN UNDERWEIGHT THE US

Despite geopolitical shocks, fiscal turmoil, and structural imbalances, US stocks continue to grind higher. Retail investors are pouring into the market at an unusually aggressive pace – buybacks by corporations have reached $4bn a day – and nearly half of US household wealth is now in equities, surpassing even the dotcom bubble peak.

To some, this is a sign of resilience. To us, it’s a reason for caution. The disconnect between economic uncertainty and investor behaviour is widening. Markets are brushing off warnings about slowing earnings, rising inflation, and weakening growth – and that’s exactly when risk becomes underpriced.

We see fragility in the following areas:

- Valuation Risk: Multiples are near record highs, driven not by sustainable profit growth but by sentiment. As noted above, the earnings yield on equities is now below that of Treasuries – a historically bearish signal.

- Political Volatility: Tariff policy remains erratic. Congress is pursuing tax cuts while deficits climb. The Fed’s independence is under pressure, and appointments increasingly political.

- Housing Weakness: US home affordability has collapsed, inventories are rising, and buyer sentiment is near record lows. This is not just a housing issue – it’s a confidence issue.

- AI Overexuberance: America’s dominance in AI has driven another speculative boom. But the path from AI infrastructure investment to earnings is unclear. Investors still don’t know who will profit – or when.

In short, the market’s resilience appears increasingly disconnected from fundamentals. With valuations stretched and policy direction uncertain, we see limited justification for increasing exposure at this stage.

THE CASE FOR GOLD

Against this backdrop, gold has quietly done its job.

It has risen steadily this year, supported by robust central bank demand and widespread concerns about the long-term credibility of dollar-based finance. In Europe, there are growing calls to repatriate gold reserves held in US vaults – a symbolic but telling sign of fraying trust.

What’s changed is that gold is no longer just an inflation hedge. It’s a hedge against monetary disorder, geopolitical coercion, and institutional mistrust. And unlike crypto – often dubbed “digital gold” – it has held firm in times of genuine stress. When tensions between Iran and Israel escalated earlier this year, crypto sold off. Gold didn’t flinch.

We hold gold in client portfolio not for yield or speculation, but for ballast. It’s not about betting on catastrophe. It’s about preparing for volatility.

PREPARING FOR A MULTIPOLAR MARKET

The world is shifting. The post-2008 consensus – low rates, dollar dominance, US exceptionalism – is cracking under the weight of new realities. Markets will continue to rise and fall, but the ground beneath them is no longer as firm.

Our positioning reflects this: a measured underweight to US equities, selective exposure to undervalued global markets, continued allocations to real assets like gold, and preference for structurally uncorrelated strategies.

As we look ahead to the second half of 2025, we continue to believe that the most effective strategy is one grounded in prudence, not speculation.