Guilty: What Next For Donald Trump?

31 May 2024

Sign up to our newsletter for regular insights from the Hundle team.

In a dramatic development that is certain to resonate across the political and investment landscape, former US President Donald Trump has been found guilty on 34 felony counts related to the cover-up of “hush money” payments made in the run-up to the 2016 election.

This unprecedented conviction, arriving as Trump positions himself for another presidential run against incumbent Joe Biden, could have significant ramifications for investor sentiment and market stability as the US heads towards an historic election.

—

WHAT’S HAPPENED?

Trump has been convicted on charges of falsifying business records to conceal payments to a porn actor who alleged an extramarital affair with him. Given that these are the lowest-level felonies in New York’s legal system, carrying a maximum prison sentence of four years, it is unlikely that Trump, a first-time offender at the age of 77, will face prison. Manhattan District Attorney Alvin Bragg has been non-committal on seeking prison time, suggesting instead that other penalties such as probation or financial fines could be considered. Sentencing will occur on July 11.

Trump’s legal team is expected to appeal the guilty verdict, a process that could stretch well beyond the November election. Key points of contention include the admissibility of testimony from Michael Cohen, Trump’s former attorney and convicted perjurer, and the unique legal approach of tying business record falsifications to broader election law violations.

Despite the conviction, Trump’s campaign for the presidency remains constitutionally viable. There is no legal barrier preventing a convicted felon from running for federal office. A Supreme Court decision earlier this year affirmed that attempts to disqualify Trump from the ballot on the grounds of inciting insurrection are matters for Congress, not the judiciary. That being said, if in the unlikely event that Trump did end up in prison, it would most likely end his bid to return to the White House.

Trump’s conviction also intersects with other ongoing legal issues, including two state and federal cases related to his alleged interference in the 2020 election and the retention of classified documents. We do not expect either case to go to trial before the election, however, the possibility has now increased following the resolution of the “hush-money” case.

—

ELECTION IMPACT

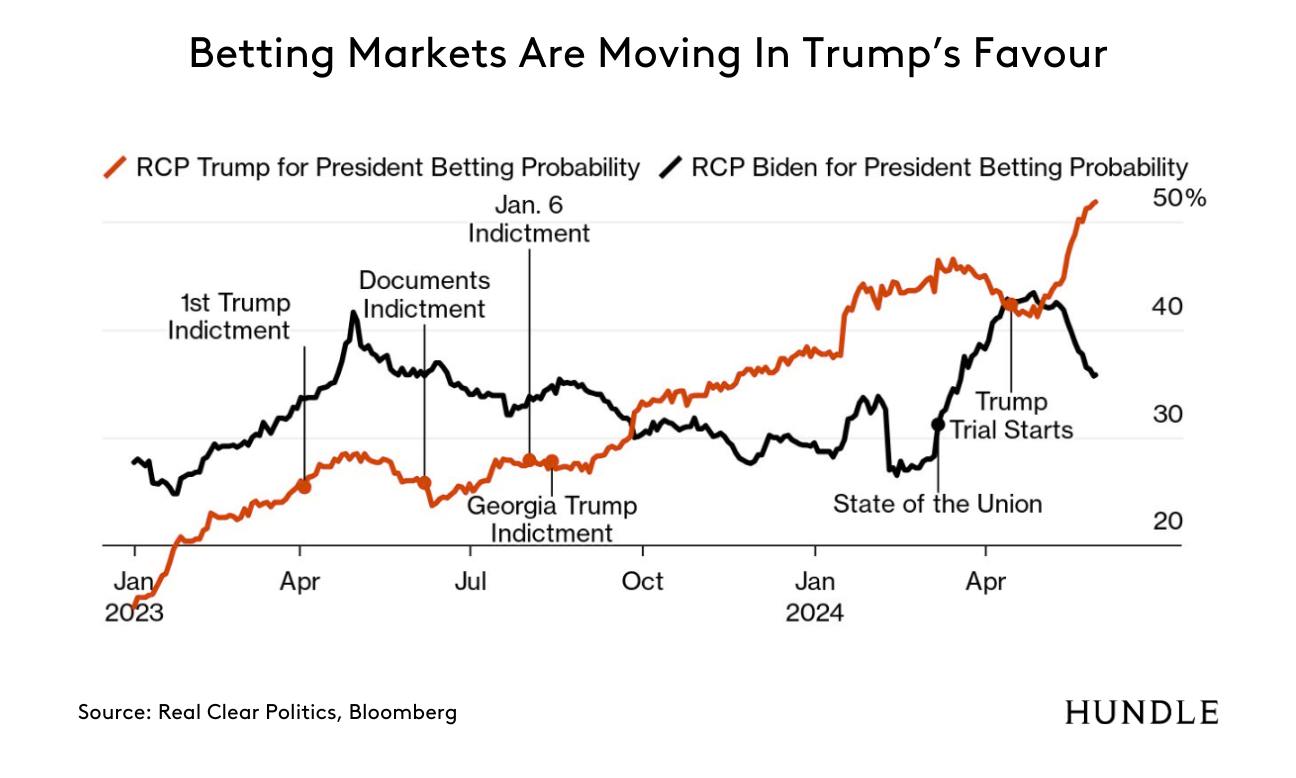

Trump’s chances in the upcoming election remain strong. Political betting markets show a remarkable shift in Trump’s favour throughout his trial. Despite poor performance at the midterm elections, betting markets now see Trump’s victory as more likely than Biden’s.

Remarkably, none of Trump’s four indictments have hindered his campaign; on the contrary, they seem to have galvanised his support base. Prominent figures in finance, including hedge fund manager Bill Ackman and Blackstone’s Stephen Schwarzman are leaning toward Trump, reflecting a broader sentiment within the financial sector.

MARKET IMPACT

So, what about the financial market impact of this conviction? It’s too early to fully understand the impact on voting intentions and markets, however, we do expect heightened uncertainty as the election approaches. Markets typically dislike uncertainty, and the prospect of a presidential candidate embroiled in legal battles adds a further layer of unpredictability.

For investors, this development underscores the need for vigilance and adaptability. The intertwining of legal battles and political campaigns is likely to foster a volatile market environment, demanding careful attention to emerging risks and opportunities. As the US navigates this unprecedented situation our investment team will be closely monitoring each twist and turn, with potential implications for asset prices, investor sentiment, and broader economic stability.