Investment Outlook 2026

2 January 2026

Sign up to our newsletter for regular insights from the Hundle team.

Entering 2025 with Discipline and Intent

2025 was defined by political shocks, tariff volatility, and an unusually unstable macro backdrop. Yet despite this noise, headline equity markets delivered strong returns driven overwhelmingly by the US and an increasingly narrow cohort of mega-cap technology companies. Beneath this headline strength, however, the market structure weakened. Traditional portfolio hedges failed, bond-equity correlation stayed elevated, and traditional diversification delivered far less protection than history would suggest. The year was ultimately a tug of war between policy noise and economic resilience, with investors repeatedly forced to reassess their assumptions about growth, inflation, and the Fed.

We entered 2025 with a deliberate and disciplined set of tactical allocations built around three convictions. Valuations mattered, global dispersion was widening, and traditional diversification benefits of the 60/40 portfolio would not hold in a regime defined by policy uncertainty and elevated correlations. Our overweight positions reflected these views. We emphasised real estate and asset-backed lending aiming to generate long-term equity-like returns, commodities with a focus on gold and alternatives such as multi-strategy hedge funds, all areas where return drivers are idiosyncratic and less sensitive to broad market swings. Within equities, we leaned into Continental Europe, the UK and European small caps, where valuations were more compelling and earnings momentum was improving. These positions were intentionally offset by a material underweight to global equities and, in particular, to the United States, where valuations appeared stretched and policy instability created risks that were not adequately priced.

The year that unfolded validated much of our fundamental macro view, even if headline markets appeared to defy it. The strong US-led rally, leading to historically high valuations based on several metrics driven by technology-focussed mega-caps, masked the deterioration in traditional hedges, the rise in cross-asset correlation and the increasing fragility beneath the surface. Our tilt toward alternatives, secured lending and attractively valued non-US equity markets proved well aligned with the realities of 2025, reinforcing the importance of resilience, selectivity and genuine diversification in a policy-driven regime and that not all returns just existed in the US technology space.

What Drove Markets in 2025?

- A Public Power Struggle: The White House vs Fed

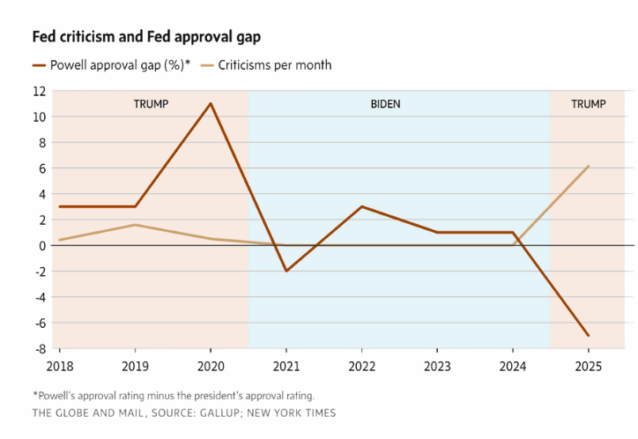

One of the defining features of 2025 was the intensifying battle between the administration and the Federal Reserve. The president publicly criticised the Fed, questioned Chair Powell’s leadership, and demanded rate cuts even as inflation remained above target. Financial markets were forced to price an entirely new form of uncertainty: the risk that political pressure might distort the central bank’s reaction function. The Fed, determined to protect its credibility, kept policy tight.

Long-end yields stayed elevated, interest rate volatility rose, and monetary guidance became less dependable. Policy was no longer just about inflation; it became a question of institutional independence. The chart below illustrates this shift clearly. As criticism from the White House intensified, Powell’s approval gap fell into negative territory, the weakest reading since 2018 and a stark contrast with his stronger standing during Trump’s first term. Even if the Fed continues to operate independently, frequent public attacks from the administration can still undermine confidence in the institution and make policy signals less dependable.

These dynamics matter for markets. In the short term, political pressure increases uncertainty around how the Fed will respond to economic data and can push inflation expectations higher. Over the longer term, repeated challenges to the central bank’s credibility weaken one of the key anchors of financial stability.

Source: The Globe And Mail

- Fiscal Dominance: When Borrowing Costs Start Driving Policy

One of the clearest macro shifts in 2025 was the re-emergence of fiscal dominance. The U.S. government’s expanding deficit and record Treasury issuance threatened to overwhelm the market’s appetite. Bond yields were no longer responding to just inflation and rate cut expectations but also to the sheer volume of supply.

As deficits grew and political uncertainty increased, investors began to demand higher yields to take on this additional risk. This is why long-term treasuries often failed to function as a safe haven this past year. Even when equities sold off, long bonds did not rally in the way investors typically expect. The traditional stock and bond offset weakened and balanced portfolios became more vulnerable because both sides could fall at the same time. This fiscal strain also reduced the Federal Reserve’s room to manoeuvre. When governments rely heavily on debt markets, central banks can face pressure to keep interest rates lower than they might prefer or to absorb more of the supply. Over time, this can weaken inflation control and make markets more fragile.

In 2025, the bond market was not the shock absorber it has been in the past. It behaved more like an early signal that fiscal conditions in the United States are becoming a growing source of market risk.

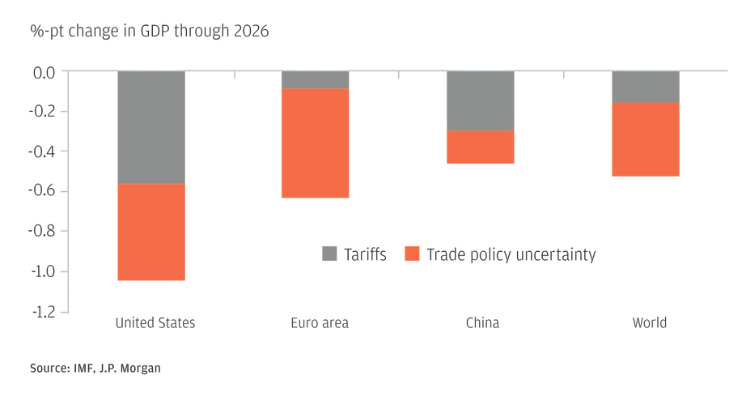

- Trade Became a Policy Weapon

Markets entered the year pricing in a benign version of Trump, expecting tax cuts, deregulation, and equity- friendly policy. Instead, the administration delivered the opposite. On Liberation Day in April, tariff announcements far exceeded anything previously signalled and triggered one of the sharpest two-day selloffs in recent history. The S&P 500 erased its early-year gains, and the narrative shifted from optimism to concerns about capital flights. Yet within weeks, the markets recovered as investors tuned out the noise, and the administration softened aspects of the policy. While tariffs hurt fundamentals, ultimately liquidity won.

Even as markets eventually shrugged off the initial shock, the tariff regime fundamentally altered global supply-chain expectations and introduced a persistent policy risk premium across equities, currencies, and commodities. Tariffs were no longer seen as a temporary bargaining tactic that could be reversed when tensions eased. They became a core feature of US policy and signalled a more confrontational approach to global trade.

For investors, the deeper consequence was rising uncertainty about the United States as a dependable economic anchor. The long-standing assumption that US institutions would deliver stability and predictability came under pressure. Businesses and asset allocators began to question whether the US-centric model could be relied on in the same way as before. Trading partners such as Europe, Mexico, Japan, and emerging Asia were forced to reassess their fiscal and industrial strategies as the cost and reliability of access to the US market became less certain. These adjustments raised risk premia not only in the United States but also in countries exposed to tariff spillovers, retaliation, or currency volatility.

Markets therefore had to reassess the stability of the global trading system itself. The result was a more cautious and fragmented environment, where both companies and investors demanded higher compensation for policy uncertainty across multiple regions.

Source: JP Morgan Research

- Sticky Inflation and Central Banks Without a Playbook

Inflation never eased in the smooth and predictable pattern policymakers had hoped for. Services inflation remained stubborn, wage growth stayed firm and periodic geopolitical shocks lifted input costs at inconvenient moments. Core PCE hovered near 3% for much of the year, an uncomfortable level that was too high for central banks to relax but not high enough to justify another round of tightening. This left central banks in an unusually difficult position. Cutting rates risked looking politically influenced at a time of open pressure on the Federal Reserve. Keeping policy tight risked slowing an economy already absorbing tariff uncertainty, supply-chain shifts and rising fiscal stress. As a result, policy guidance drifted and market confidence in forward signals weakened.

A second defining feature of 2025 was the widening divergence in central-bank actions. The European Central Bank and the Bank of England began easing as disinflation progressed and domestic conditions softened. The Federal Reserve, constrained by sticky inflation and political scrutiny, held policy steady for most of the year. In contrast, the Bank of Japan moved gradually toward tightening as domestic inflation proved more durable and wage dynamics strengthened. These conflicting policy paths reflected the different ways economies absorbed higher tariffs, currency pressures and shifting global demand. They also underscored a deeper challenge which was that no major central bank had a clear playbook for a world where inflation remained sticky, policy uncertainty was elevated, and geopolitical shocks routinely interfered with the cycle.

How Our Thesis Played Out

Many of our starting assumptions for 2025 proved correct as the year unfolded. US equities became even more expensive as a small group of mega-cap technology companies drove most of the market’s gains. The correlation between stocks and bonds remained positive, which meant duration failed to provide protection during risk-off moments. Macro fundamentals softened, yet markets continued climbing on the back of liquidity and sentiment rather than earnings breadth or economic strength. Rates stayed higher for longer than consensus expected, and the long end of the Treasury curve offered little meaningful defence.

For asset allocators, this created a difficult paradox. The underlying risks we identified were real and visible, but market prices continued to rise despite them. The rally masked a fragile market structure where stretched valuations, narrow leadership and policy uncertainty carried increasing weight. Passive exposure began to look complacent, rewarding momentum rather than fundamentals.

Our focus on genuinely uncorrelated return sources proved essential throughout the year. Multi-strategy and market-neutral hedge funds, asset-backed lending and global diversification all added resilience at a time when traditional hedges failed. These exposures helped portfolios navigate a market environment where beta became more expensive and carried more embedded risk.

As we look toward 2026, the conclusion is clear. We want less exposure to segments of the market where valuations and policy risks are highest, particularly US mega-cap technology. Our forward positioning emphasises uncorrelated strategies and areas where alpha can be earned through selectivity rather than relying on broad market direction. In a regime defined by elevated correlations and thinner leadership, portfolio stability depends on disciplined diversification and active decision-making, not on blanket passive exposure.

Asset-Class Outlook and Positioning for 2026

The landscape entering 2026 is more uneven than in previous years. Some markets have strong fundamentals and attractive valuations, while others face higher policy uncertainty and stretched pricing. In this kind of environment, choosing where to take risk matters just as much as how much risk to take. Our asset-class outlook highlights the markets and strategies that we believe can deliver resilient returns, along with the areas where caution is still warranted.

Equities: Selective Alpha over Broad Beta

The global equity landscape entering 2026 remains defined by sharp dispersion. We continue to take passive exposure where it provides efficient access to broad earnings growth, and we reserve active risk for the parts of the market that are most under-researched, most fundamentally mispriced, and most supported by structural tailwinds.

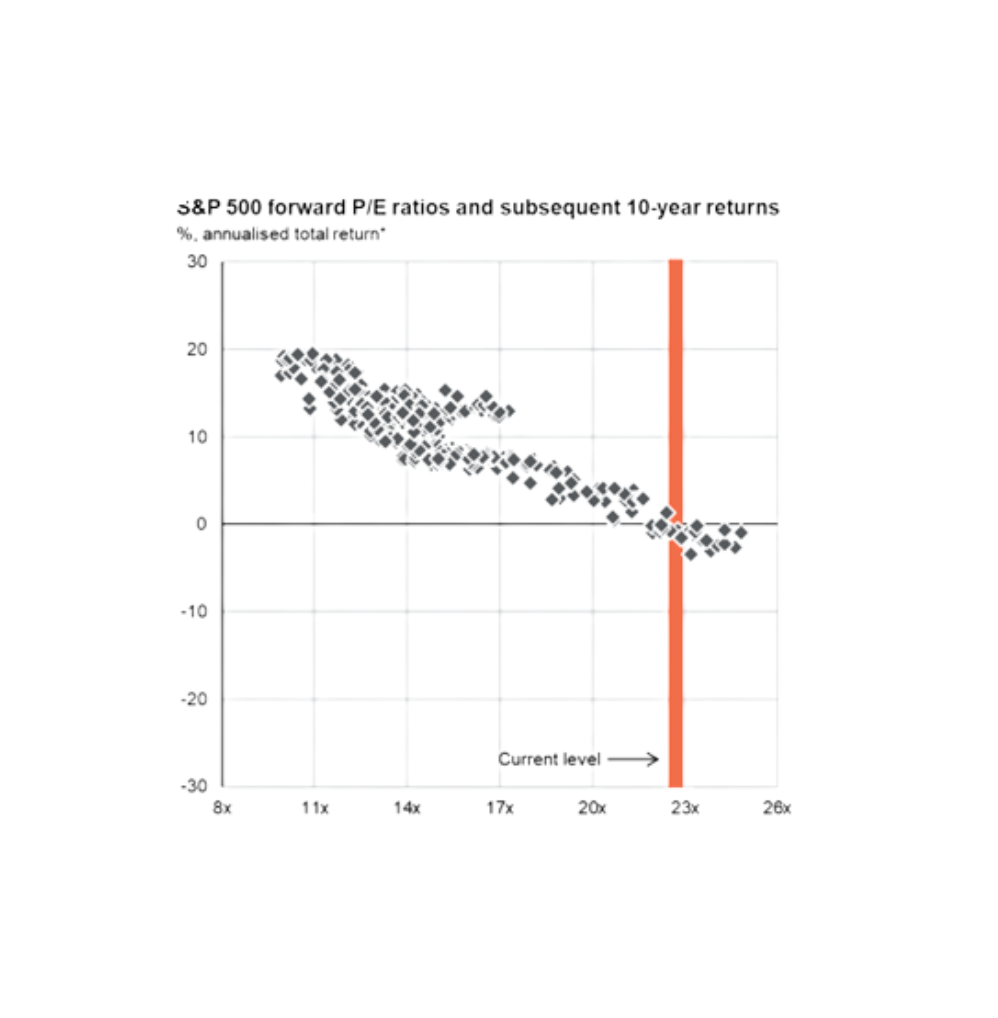

Our largest tactical call within the equity space is that we remain underweight on the United States. Valuations are stretched, leadership is narrow, and policy risk is high. With the S&P 500 increasingly dependent on a small group of mega-cap technology companies, passive exposure embeds concentration and political uncertainty without offering adequate compensation. Our equity benchmark is MSCI ACWI, the All-World which is 64% exposed to US equities. This is in contrast to our current equity exposure which is 50% exposed to the US. We redeploy this exposure into overweight positions in markets where we believe the forward returns are more attractive, notably Japan.

The graph below shows the subsequent annualised 10-year returns for the S&P 500 when valuations were historically at current levels. Based on this measure, annualised 10-year returns for the S&P 500 would be negative.

Source: JP Morgan Research

The graph below shows the concentration of US equities in global equities, Tech sector weight in the US market and the share of the largest shares in the S&P 500. The Top 10 stocks represent 42% of the S&P 500. The tech sector represents 35% of the S&P 500 which surpasses the weight it reached in 2000.

Source: JP Morgan Research

Europe stands out for its combination of valuation support and policy stability. Inflation has eased more reliably than in the US, fiscal frameworks are more disciplined, and earnings momentum is improving across Germany, France, Italy, and Spain. As a result, we are currently screening active managers, particular long/short managers, who can take advantage of the bifurcated opportunities in Europe.

China continues to reflect structural rather than cyclical challenges. Weak consumer confidence, a fragile property sector and measured stimulus kept growth subdued, while US tariff pressure persisted. Without a clear catalyst for broad re-acceleration, we retain a highly selective, bottom-up approach rather than broad exposure.

Japan offers strong corporate fundamentals supported by governance reform and solid earnings, but yen weakness remains the key challenge for foreign investors. Japan is attractive, but returns depend heavily on currency management, which reinforces the need for targeted rather than blanket exposure, hence our preference for active equity management here.

Emerging markets remained widely dispersed in 2025. India and Mexico led on the back of strong domestic demand, credible policy and accelerating near-shoring flows. Other regions lagged due to political instability, inflation pressures, or exposure to China’s slowdown. This environment underscores the need for selective EM allocation focused on countries with fiscal credibility and stable real rates. This is an area of focus for us in 2026 which we are working on.

Credit: Focusing on Idiosyncratic Risk, Not Tight Spreads

Credit markets remained orderly through 2025, but spreads stayed persistently tight relative to the level of macro uncertainty. At today’s valuations, we believe broad credit indices do not offer adequate compensation for rising policy volatility, fiscal pressure or uneven corporate fundamentals. Credit now looks increasingly expensive, with spreads compressed to levels that appear out of line with a late-cycle environment.

Against this backdrop, passive, benchmark credit exposure strikes us as unattractive given its vulnerability to a repricing. Policy volatility, asymmetric macro risks, and growing dispersion across issuers heighten the probability that broad indices will deliver poor forward returns. Rather than relying on credit market beta and taking long-duration risk, where we are not being adequately compensated, we prefer strategies that can remain flexible, avoid crowded trades, and selectively deploy capital where risk premia are mispriced.

We see significant opportunity in absolute return active credit strategies designed to harvest alpha from market inefficiencies. Credit remains one of the most structurally opaque and fragmented asset classes. Documentation differs by issuer, covenants vary widely, and information flow is far less uniform than in equities. These characteristics create persistent pricing dislocations that skilled managers can exploit through relative-value trading, bespoke structuring, capital solutions, distressed and special-situations investing, and dynamic risk management. In our view, this opacity is precisely what makes opportunistic credit a rich hunting ground for alpha. A flexible, multi-strategy approach allows capital to rotate across the most attractive pockets of risk, rather than being locked into rigid benchmarks, positioning the portfolio to generate returns independent of the direction of spreads.

Alongside this, we also favour asset-backed lending. In a market where traditional spread products are trading at historically tight valuations, ABL offers a fundamentally different return engine. One anchored in collateral quality, cash-flow visibility, and underwriting discipline rather than market movements. Structural protections, senior positioning, short duration and bespoke covenant packages create a favourable asymmetry of outcomes. Because collateral pools vary widely and documentation is negotiable, skilled lenders can capture illiquidity and complexity premia that public markets do not offer. In an environment of elevated macro uncertainty, secured lending tied to identifiable assets provides a clearer margin of safety and more predictable risk-adjusted returns than benchmark credit exposure.

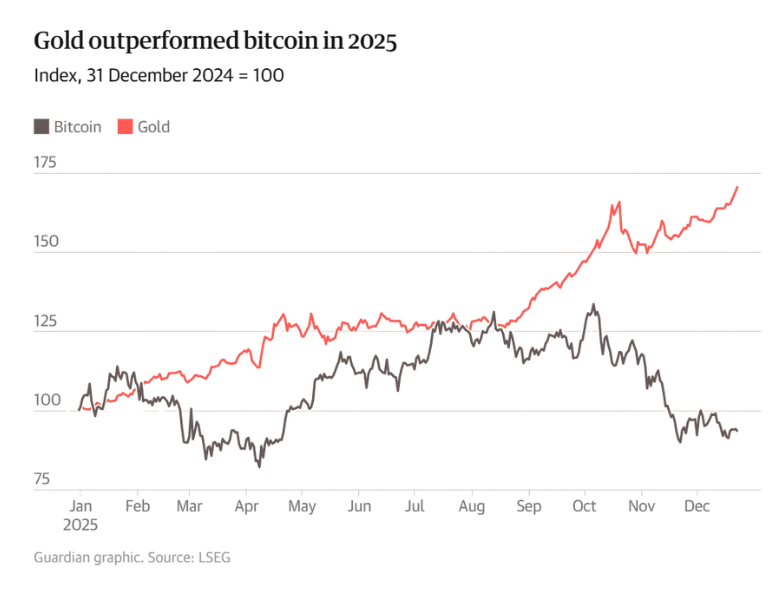

Commodities: Gold as a Mirror of Fiscal Anxiety

Gold delivered one of its strongest years in decades, reflecting a global search for assets outside the traditional financial system. This rally was fuelled by fiscal concerns, political volatility, and erosion of U.S credibility. Its performance mirrored the broader question facing markets: how much faith should investors place in fiat currency systems when fiscal deficits rise and central bank independence becomes uncertain? We had added to gold at the end of 2024 and so participated in this move. We particularly like gold as we believe it is an important portfolio diversifier at a time when bonds have struggled to provide protection.

Crypto told a vastly different story. Bitcoin and Ethereum rallied meaningfully during the year, but their behaviour remained closely tied to broader risk sentiment rather than safe-haven demand. Correlations with equities stayed high and performance continued to be driven by liquidity conditions and speculative flows. Although crypto often rises in parallel with gold, the underlying drivers are not the same. Gold responds to a crisis-of-confidence environment, while crypto continues to respond to risk appetite. As a result, we observe the space but do not treat crypto as a strategic hedge.

Source: The Guardian

FX: A Weaker Dollar and the Need for Hedging Discipline

The dollar lost momentum through the year as fiscal concerns deepened and real yield support moderated. With political uncertainty rising and debt issuance accelerating, the dollar is likely to remain under structural pressure as the traditional US-centric model is called into question. We continue to hedge US dollar exposure in non-USD portfolios where appropriate and maintain diversified currency exposures tilted toward economies with stronger fiscal positions and clearer monetary frameworks.

Alternatives: The Cornerstone of Portfolio Stability

We view our alternatives as a genuine diversifier, and they have proved to be essential in 2025. Multi-strategy and market-neutral hedge funds provided true diversification at a time when traditional hedges failed. Real-asset-backed lending strategies delivered stable income insulated from public-market volatility. As the correlation structure of markets becomes more unstable, these strategies are no longer optional but foundational. When correlations rise, many nominal “diversifiers” fail to provide meaningful protection. We therefore allocate to multi-strategy managers across macro, relative-value, equity-market-neutral, and event-driven approaches that are specifically designed to offer uncorrelated return streams and shock absorption. These allocations support our ability to remain invested through bouts of volatility, converting uncertainty into an incremental source of return rather than a trigger to de-risk at the worst moment.

2025’s advance was led by policy expectations, liquidity tone, and AI leadership. Going into 2026, if earnings breadth narrows or long-end bond supply keeps pushing term premia higher, the setup becomes more fragile. Our portfolio stance reflects that reality: global equity beta at the core, active tilts only where conviction is strong, and meaningful allocations to diversifiers such as multi-strategy hedge funds, strategic gold, and private credit, to participate in the upside while being conscious of the increasing downside risk.