EUROPEAN PARLIAMENT RESULTS

European Parliament elections have provided a mixed yet significant outcome for the region’s political landscape. Parties of the centre retained a majority in the new parliament, as early results showed the centre-right European People’s party was on track to win 184 seats, leaving the Socialists and Democrats in second place with 139 seats, with the liberal Renew group on 80, remaining in third place.

At the same time, far-right parties have made significant gains, however notable shifts occurred within individual countries. Populist parties faced setbacks in Poland, Finland, the Netherlands, and Sweden, whereas France and Germany saw a sharp rise in far-right parties including Marine Le Pen’s National Rally (RN) and the Alternative for Germany.

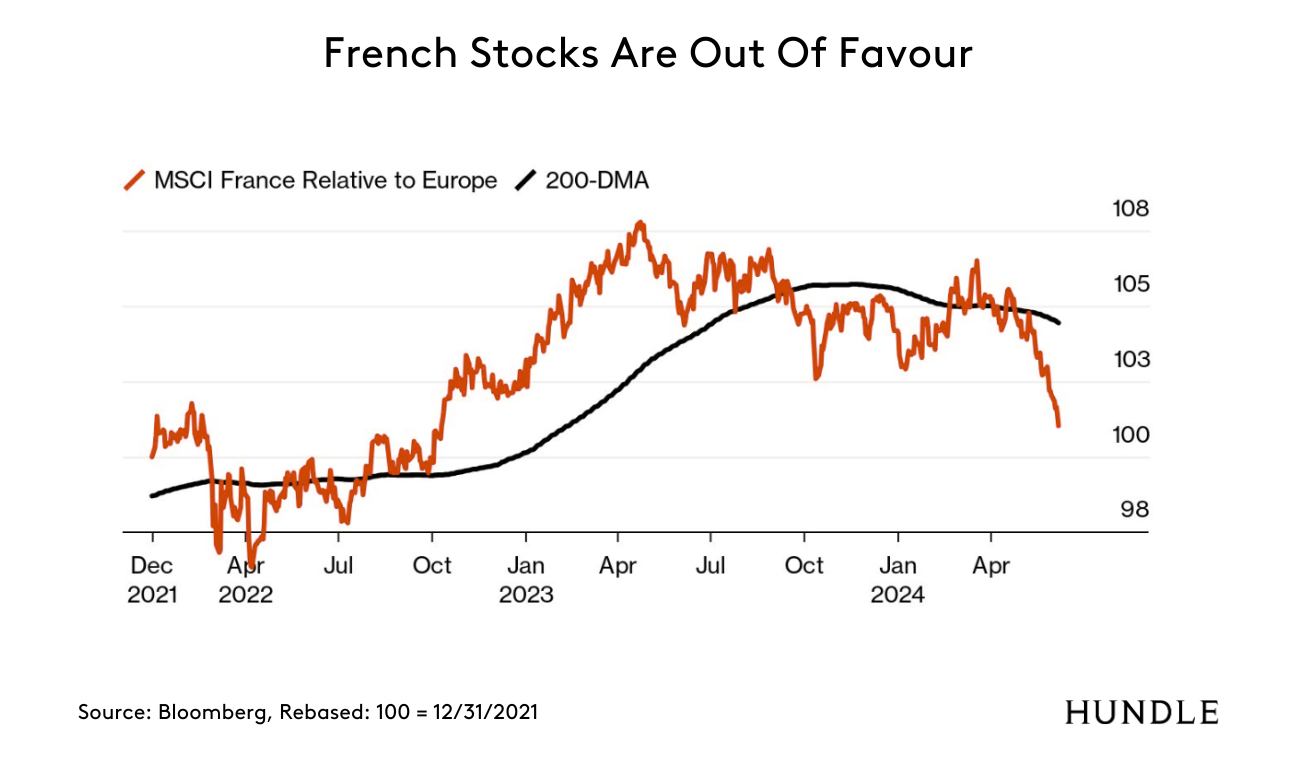

France’s political situation is particularly delicate. President Emmanuel Macron’s party was significantly outvoted by the RN, prompting Macron to call for surprise parliamentary elections. This move risks putting France in a ‘cohabitation’ scenario where the president and the majority in parliament come from opposing parties. This political uncertainty is reflected in the bond markets, with the spread between French and German bond yields widening, indicating increased perceived risk in French assets.

The potential for a Le Pen-led government raises concerns about market stability in France, especially given recent sovereign credit rating downgrades and stock market underperformance.

US ECONOMIC DATA

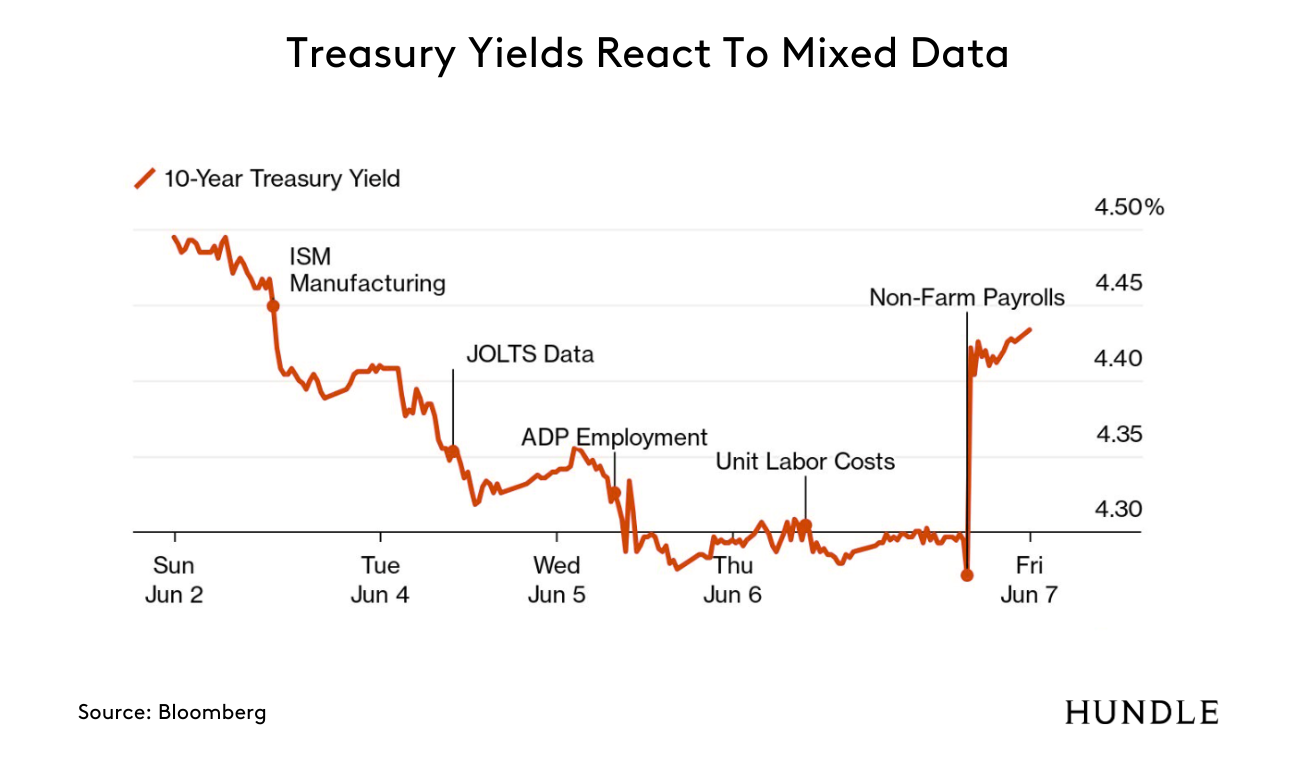

Recent US economic data presents a complex picture: while last week’s manufacturing data showed signs of weakness and job vacancies decreased, non-farm payrolls exceeded expectations, and average weekly earnings rose. This mixed data complicates the Federal Reserve’s task of managing interest rates to control inflation without stifling employment and growth. The Fed’s first interest rate cut, initially expected in July, is now anticipated later in the year.

The bond market’s reaction last week, with fluctuating Treasury yields, underscores the uncertainty. The upcoming Federal Open Market Committee meeting and new ‘dot plot’ projections will be crucial in guiding market expectations. Our view is that any policy easing will be dependent on a renewed and consistent fall in prices over the summer months and it is premature to take this outcome for granted. We remain underweight US equities in client portfolios due to concerns about valuations, however we are always prepared to adjust our positioning as the market narrative evolves.

ECB INTEREST RATE CUT

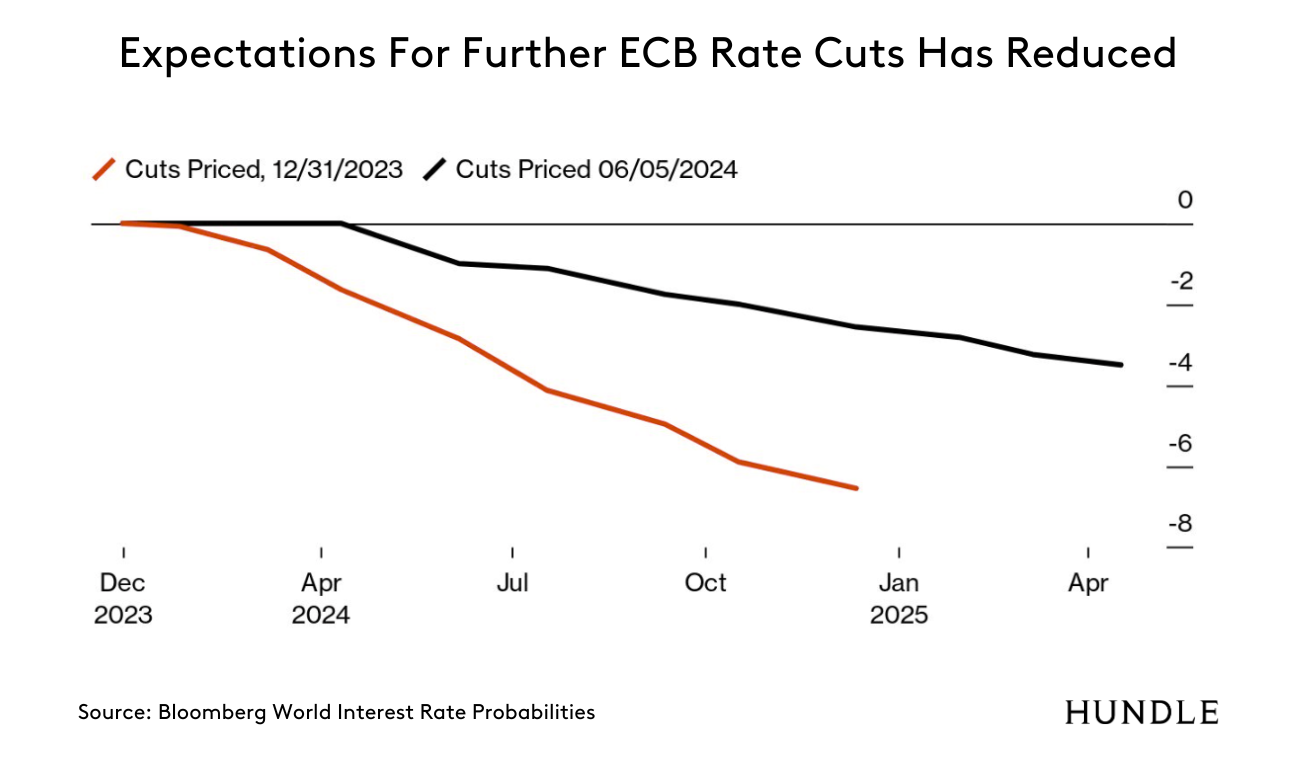

The European Central Bank followed Canada, Sweden and Switzerland and cut interest rates last week for the first time since 2019, citing a sustained decline in inflation. This marked a significant departure from its historical pattern of following the Federal Reserve’s lead. This decision reflects a strategic shift aimed at addressing economic conditions specific to the eurozone. The market reaction was benign as ECB President Christine Lagarde delivered a well telegraphed 25bps reduction in rates, and emphasised caution, indicating no pre-commitment to further rate reductions.

Looking ahead, economic growth in Europe remains behind the US, but has begun to trend in the right direction. There are tentative signs of a recovery in the problematic manufacturing sector, while wage inflation in the Eurozone now appears to be under control. Equity valuations in Europe, specifically in the UK, continue to look compelling, particularly when compared to the US.

JAPANESE YEN WEAKNESS

Despite interventions to stabilise the currency, the Japanese yen remains one of the poorest performers among developed market currencies this year. Factors such as US dollar strength, outflows due to mergers and acquisitions, and increased investments in foreign equities have compounded the yen’s decline. The narrowing yield spread between US Treasuries and Japanese bonds offers some hope for yen appreciation, but structural and cyclical challenges persist.

We will be watching this week’s Bank of Japan meeting closely, as speculation has increased that Governor Ueda will announce a significant reduction in bond purchases to support the yen. Despite currency issues, the broader economic backdrop in Japan remains positive and we retain our constructive outlook on Japanese equities. Mild inflation, corporate reforms to boost shareholder value, and normalisation of monetary policy is expected to unlock value embedded in the Japanese market. Moreover, Japanese stocks continue to look attractively valued at a 10% discount to global equities on a P/E basis compared to a long-term historical average of a 4% premium. This comes at a time of significant corporate changes including greater share buybacks and dividend increases, supporting our positive view of Japanese equities.

—

ELECTION RESULTS IN INDIA, SOUTH AFRICA, AND MEXICO

The recent elections in India, South Africa, and Mexico have each had significant impacts on their respective markets.

In India, Prime Minister Narendra Modi’s Bharatiya Janata Party (BJP) won the election but lost its parliamentary majority. This outcome was surprising because exit polls projected a big win for Modi and predicted he could secure a two-thirds majority. The actual results led to dramatic trading in the benchmark Sensex index, which initially surged on exit polls indicating a landslide victory, only to fall sharply when the results were announced. The market volatility was driven by investor concerns over the stability of a coalition government and its potential impact on Modi’s economic reforms and infrastructure projects. Particularly hard-hit were companies within the Adani Group, which faced significant selloffs due to fears of reduced spending on major infrastructure initiatives.

Investors’ disappointment was also attributed to the high valuation of Indian stocks, which had become the most expensive among major global markets. Some investors saw the election results as an opportunity to take profits from their Indian investments.

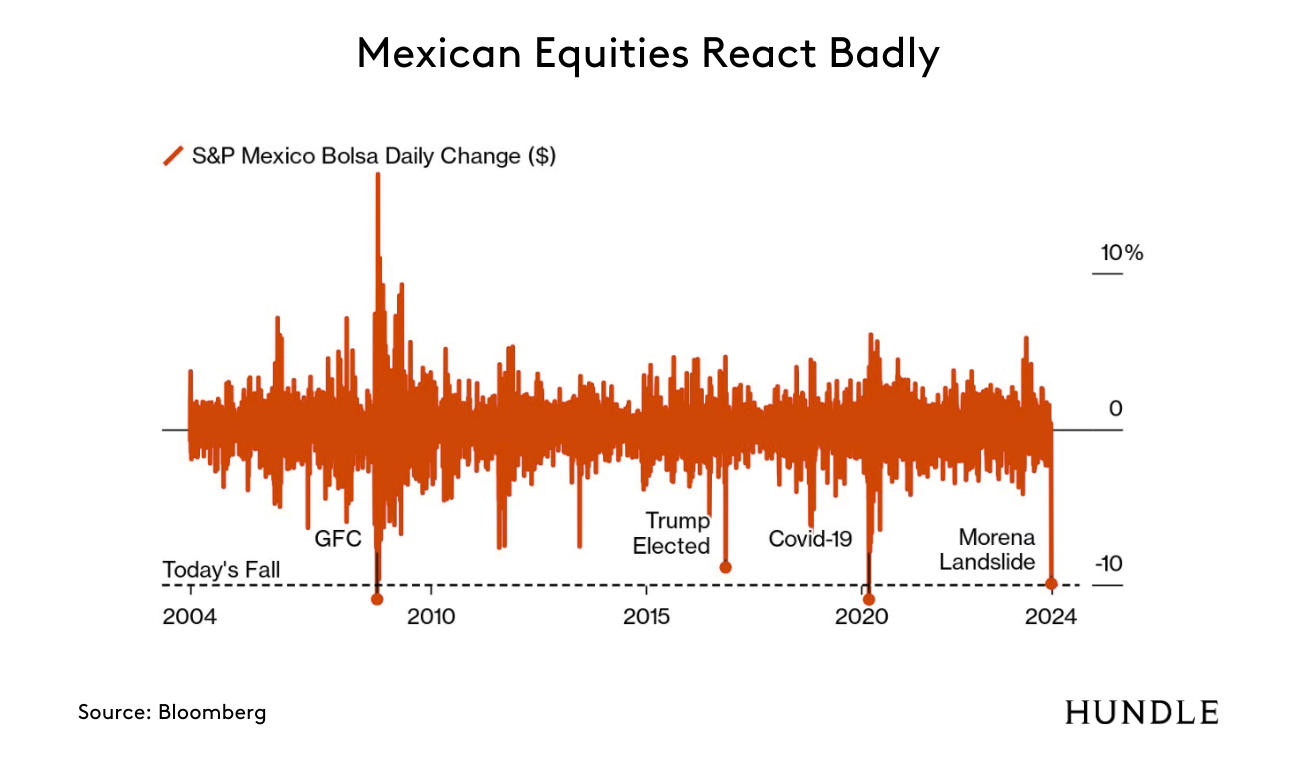

In Mexico, Claudia Sheinbaum of the Morena party exceeded expectations, winning a supermajority in the lower house of Congress. The confirmation of the supermajority triggered a significant market selloff in the Mexican peso and stock market due to concerns about a fiscally expansive redistributionist agenda and the possibility of constitutional change. The peso fell by 4% at the start of the week, only to partially recover on reassurances that any changes made would mitigate the impact on the deficit or the broader Mexico macro picture.

Finally, in South Africa, the African National Congress (ANC) lost its parliamentary majority for the first time in three decades. The formation of a coalition government introduces uncertainty but has so far been met with relative market calm.

These election outcomes highlight the complexity of political risk in investment decisions. The Indian market’s reaction underscores the dangers of over-reliance on polls and the challenges of predicting political impact on markets. Investors need to consider valuation levels and the broader geopolitical context when making decisions. The recent volatility in these markets might present buying opportunities and we remain constructive on the longer-term economic outlook for India.

UK POLITICS

Prime Minister Rishi Sunak’s leadership skills are under the spotlight, as the resurgence of Nigel Farage’s Reform Party threatens to further destabilise British politics as we approach the election. The Conservative Party’s recent missteps, including Sunak’s ‘no-show’ at a D-Day commemoration event, have left the party vulnerable, and, in our view, it is conceivable that Reform could overtake the Conservatives in the polls.

Our base case remains that Labour will win a majority at the upcoming general election, and this will result in a period of relative calm which will benefit UK equities. However, we will monitor developments closely, particularly regarding any shifts towards more extreme or populist policies.

—

OUTLOOK

Despite higher Treasury yields and political volatility this year, equities and credit markets have performed well. That being said, recent weeks have underscored the intricate link between politics and markets across the globe. This dynamic will be crucial as the US election approaches. National polls remain close, though momentum is shifting towards Trump in key swing states. Less than six months from polling day, doubts about President Biden’s cognitive abilities, exacerbated by a recent Wall Street Journal article, are undermining his position.

In the near-term, there are a number of key economic reports and decisions on the horizon. Critical US data points, including CPI reports, payrolls, and the Federal Open Market Committee meetings will likely shape market movements in the coming months. We will keep investors updated as events unfold.