Market Update December 2023

7 January 2024

Sign up to our newsletter for regular insights from the Hundle team.

There was plenty to be cheerful about over the festive period for investors, as market sentiment was bolstered by the easing of inflationary pressures, optimism about the possibility of interest rate cuts by central banks and a potential economic ‘soft landing’ in the US. The result was a powerful rally in November and December in both bond and equity markets.

—

MACRO

Inflation steadily declined in the fourth quarter of 2023, following a year dominated by tight monetary policy in both the US and Europe. The US Consumer Price Index rose by 3.1% in November, while in the UK headline inflation slowed to a two-year low. Eurozone inflation came in at 2.4%, which is edging closer to the European Central Bank’s 2% target.

All major central banks left interest rates unchanged during the quarter, which led markets to anticipate that the current tightening cycle had peaked. This dovish sentiment was reinforced in December, when the US Federal Reserve kept interest rates unchanged at the current range of 5.25%-5.50%, while revealing that policymakers expected three rate cuts in 2024.

In the UK, the Bank of England held interest rates at 5.25%, and outlined a gradual decline to 4.25% by the end of 2026. The European Central Bank also kept rates unchanged, and guided for a “decline gradually over the course of next year”.

Economic performance continued to diverge between countries in Q4. The US economy, supported by a strong labour market, delivered impressive GDP growth of 4.9% between July and September. European economies were not so resilient, with both consumer spending and manufacturing activity softening in the UK and eurozone.

EQUITIES

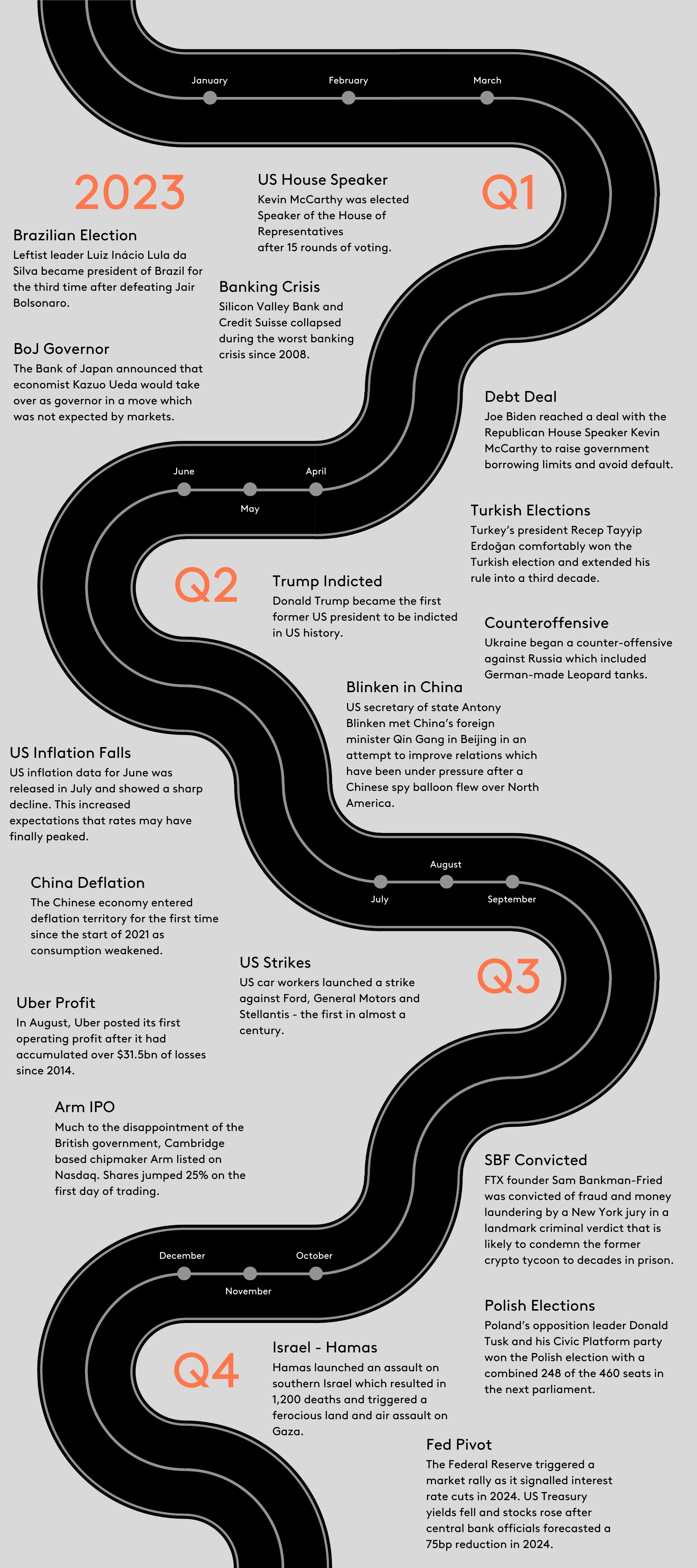

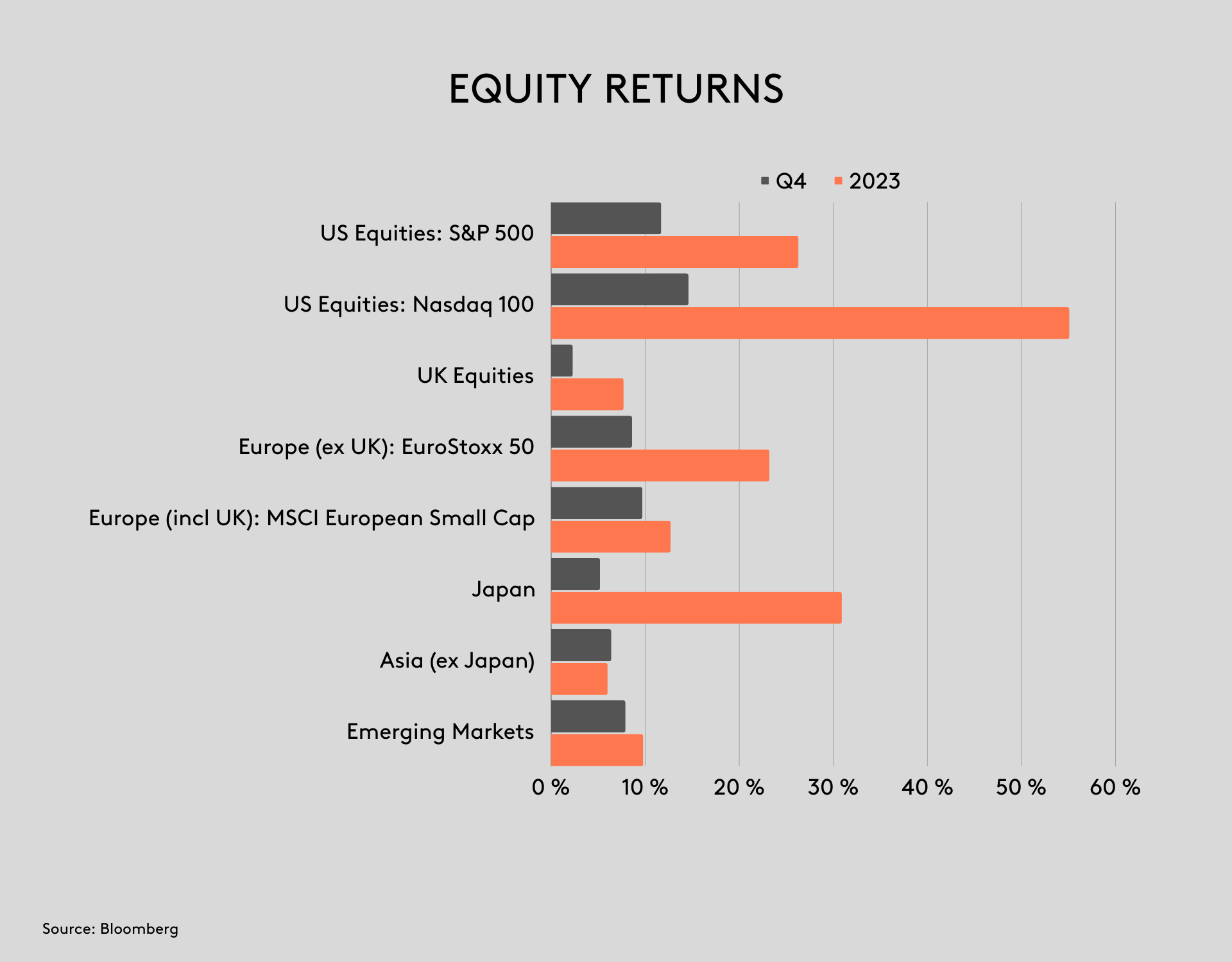

After a challenging third quarter, equity markets were buoyant during the final months of the year. Unsurprisingly, US technology stocks led the charge, with the tech heavy S&P 500 up +11.7% in Q4 2023 on a total return basis. 2023 was the year of the ‘Magnificent Seven’ – a basket of US technology giants who are perceived to be major beneficiaries of AI. This narrow group of stocks were responsible for a staggering 80% of the S&P 500’s returns over the course of the year. In December there was evidence of broader equity market strength, with Global REITS and Small Cap stocks posting strong returns. That being said, after a torrid 2022, Growth stocks were the clear winners in 2023, returning +37.3% versus a return of +12.4% for Value stocks.

Japanese equities had a disappointing finish to the year, returning just +2.0% over the course of the fourth quarter. This relative underperformance can be attributed to the fact that Japanese equities are less likely to benefit from dovish central bank policy than their US, European or Emerging Market counterparts. Japanese interest rates remain very low, with the Bank of Japan holding overnight interest rates at -0.1% and managing 10-year government bond yields, through its so-called “yield curve control policy”. Despite this, the Japanese NIKKEI Index was the top performing country index for the year, returning +30.9% on a total return basis.

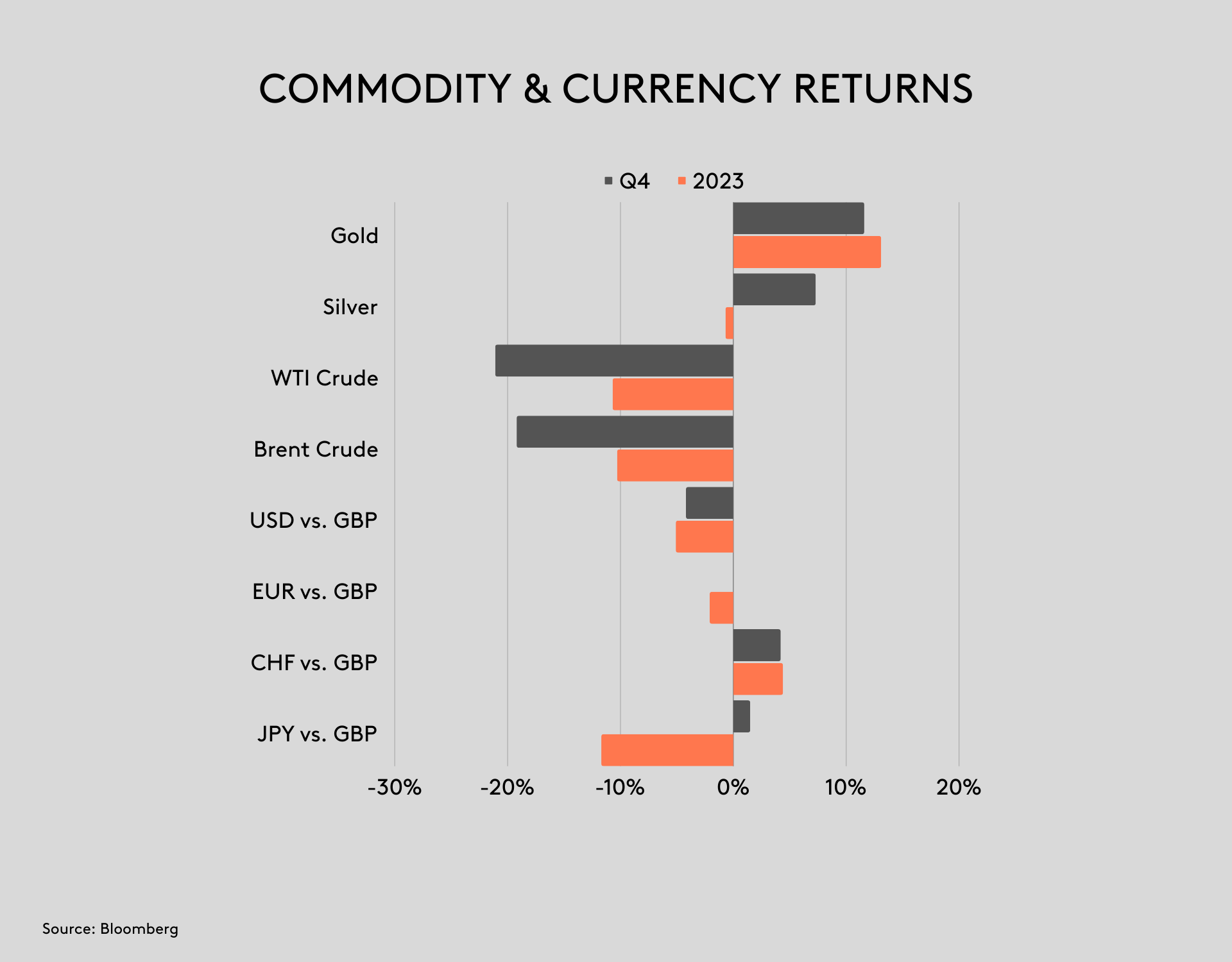

UK stocks continued to lag in Q4. The FTSE All-Share returned +3.2% for the quarter, and finished the year up +7.9%. The strength of Sterling negatively impacted returns in Q4, compounded by poor performances in commodities. This was particularly challenging for an index heavily reliant on the energy sector. Real estate and utilities, two sectors that are perceived to be sensitive to interest rates, registered healthy gains. Industrials and information technology also rallied. In contrast, defensive areas such as consumer staples and healthcare were laggards.

Throughout the year, emerging market returns have been hampered by concerns about the Chinese economy. This persisted into the final quarter, however the MSCI EM index still returned +7.9% in US dollar terms, with Argentina, Peru, Mexico and Brazil leading the way. Shares in Argentina responded positively to the election of Javier Milei as president, whilst Brazil’s stock market hit a record high after its central bank cut interest rates and flagged that they had further to fall.

FIXED INCOME & CREDIT

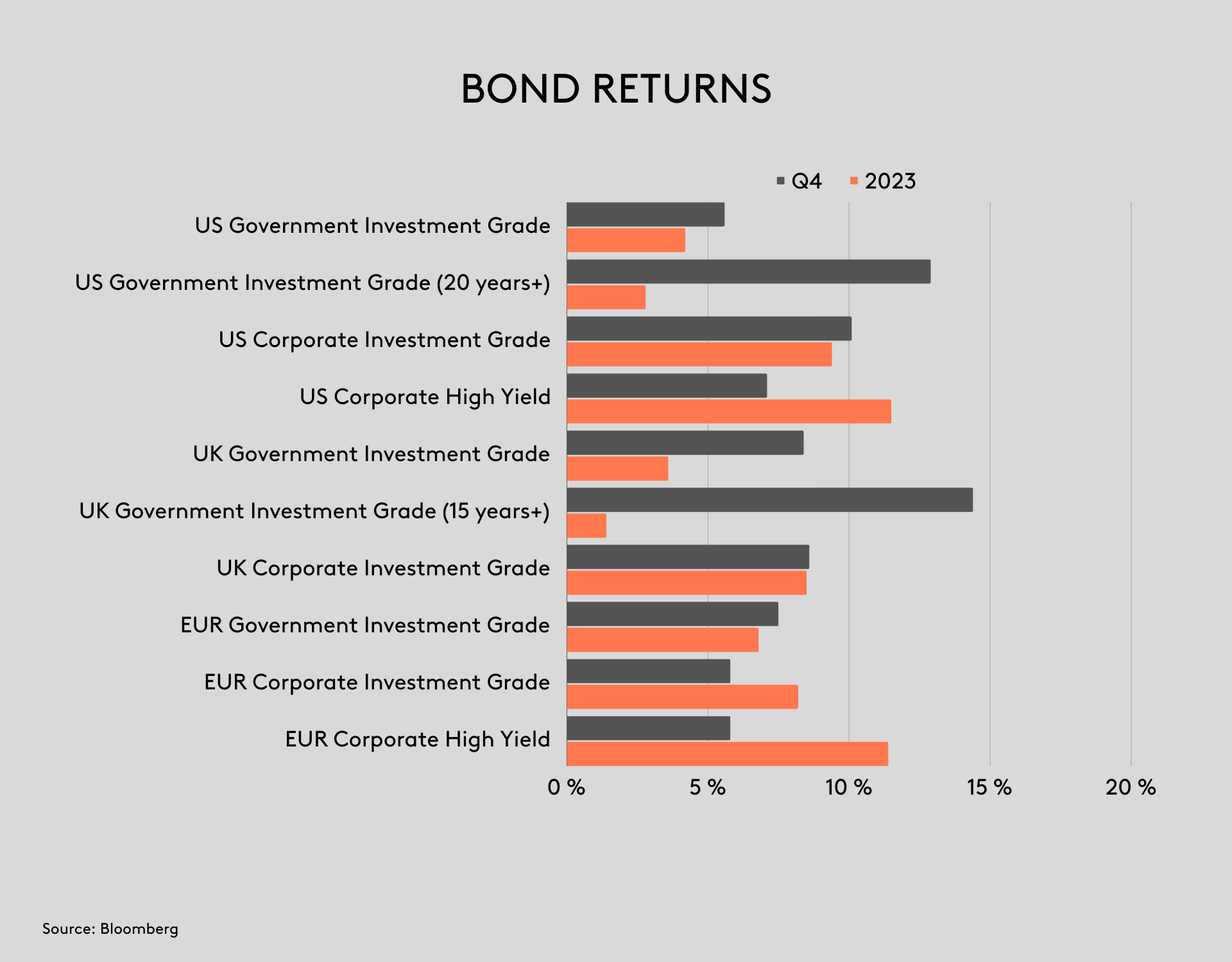

Bond markets avoided a third consecutive year of losses as the fourth quarter of 2023 saw a two-month rally in bond prices driven by increased expectations of interest rate cuts by major central banks in 2024. Bond yields fluctuated throughout the quarter – the US 10-year Treasury yield reached 5.0% in October, its highest level since 2007, before retreating on the back of falling inflation figures and the prospect of interest rate cuts. The 10-year yield ended the year at 3.87%, broadly in line with its level at the start of 2023, which translated into a return for the quarter of +6.8% in US dollar terms.

UK government bonds outperformed Treasuries in Q4 as the Gilt index benefitted from its longer duration composition. Gilts were supported by increased expectations of interest rate cuts by the Bank of England, as annual inflation eased to 3.9% in November. Having risen in October, the yield on the benchmark 10-year gilt subsequently fell in November and December to end 2023 at 3.6%, down from 4.4% at the end of the third quarter.

Tightening spreads were supportive of Italian and Spanish debt. Italian government bonds were the top performing sovereign market during the final quarter, generating total returns of over +9.3% for the year.

It was a similar story in credit markets, as tightening spreads drove positive returns for investors. Riskier pockets of fixed income, such as high yield and emerging markets, were the main beneficiaries.

COMMODITIES

Oil prices fell -21.1% in Q4 2023 despite production cuts and concerns about potential supply disruptions resulting from the conflict in the Middle East.

Despite real rates remaining elevated, the gold price hit a record high in December. This move was supported by a weaker US dollar after the Federal Reserve signalled it would start to cut rates in 2024. As gold is largely priced in dollars, US dollar weakness gives non-US gold buyers more purchasing power. Moreover, gold is considered a geopolitical hedge, and proved attractive as tensions in the Middle East flared. Central bank buying of gold has also increased, as emerging market central banks, particularly those at a higher risk of US sanctions, look to reduce their reliance on the dollar.

—

PRIVATE MARKETS & REAL ESTATE

Our private markets investment team have continued to focus on opportunities across venture capital, private equity and private credit. In Q4 we led a raise for ABSL – a British company that develops technology in the field of waste to biofuels, effectively converting waste that would go to landfill or incineration into valuable carbon negative biofuels. ABSL’s is a world-leading and potentially game changing technology, as carbon negative fuel production will be an essential component of the pathway to net zero.

Recently, ABSL produced their first tar-free contaminant-free syngas at their demonstration plant in Swindon and, just before Christmas, completed their first ‘tap’ of the furnace – removing molten slag from the plasma furnace. We are really pleased to see the team meet these critical milestones, setting the company up to move into commercial biomethane production this year, and providing a platform for the next funding round which will support the work at their first industrial scale plant at Protos.

In 2023, private debt continued to establish itself as a major asset class, with over $1.6 trillion of debt in issuance globally according to Blackrock. Within this, there is c.$400bn of dry powder ready to be deployed. Direct lending remains the largest private debt strategy by assets under management, however interesting opportunities also exist in distressed and opportunistic lending. We anticipate that the higher cost of capital will cause performance dispersion and present opportunities for specialist managers who understand the importance of credit selectivity, prudent underwriting, and structural protections.

Global Real Estate valuations are still adjusting down from their 2022 peaks, as a result of higher inflation, interest rates and volatility. This dislocated environment presents opportunities for investors to opportunistically acquire high-quality assets at attractive valuations. It is important to note that there are strong headwinds. According to Blackrock, transaction volume globally is down 57% year-over-year, largely due to the higher cost of capital. In the near term, limited financing availability will likely contribute to an environment that’s very different from the low-rate world that followed the global financial crisis.

POLITICS

The horrific Hamas attack and Israel’s devastating retaliation was the defining geopolitical event of 2023. The significance of these events extends beyond the Middle East. Much like Russia’s invasion of Ukraine, we see this conflict as part of an accelerating trend towards greater geopolitical instability. The prospect of maritime trade disruption in the Middle East, particularly in the Strait of Hormuz, has the potential to cause energy prices to spike and reignite inflation just as central banks seem to finally be getting a grip on prices.

2023 saw leftist leader Luiz Inácio Lula da Silva became president of Brazil for the third time after defeating Jair Bolsonaro. In Turkey, president Recep Tayyip Erdoğan comfortably won the Turkish election and extended his rule into a third decade. And Poland’s opposition leader Donald Tusk and his Civic Platform party alongside two smaller partners won the Polish election with a combined 248 of the 460 seats in the next parliament.

In 2024 some 2 billion people, about half the adult population of the globe, will have the chance to vote, far more in one year than ever before. While predicting the outcome of elections is highly challenging, our investment and wealth structuring teams are keeping a close eye on polls and proposed policies to ensure we are well prepared no matter the outcomes.

Presidential elections in Taiwan will take place on 13 January. The key issue for this election will be the candidates’ attitudes towards China. Lai Ching-te, Taiwan’s vice-president and nominee for the incumbent Democratic Progressive Party (DPP) is more hawkish on China than other candidates which could have significant geopolitical implications.

India will go to the polls in April. Prime Minister Narendra Modi and the BJP will be aiming to get re-elected for a third term despite being challenged by the Indian National Developmental Inclusive Alliance – a coalition of 26 opposition parties.

The US presidential election will take place on 5 November in what is expected to be a rematch between Joe Biden and Donald Trump. The outcome of this election will have major implications for both domestic and international affairs, with the two candidates offering starkly different viewpoints on key issues such as the war in Ukraine and climate change. While the result is far from certain, December’s signal by the US Federal Reserve that the interest rate cycle has peaked could be a major tailwind for Biden.

We expect the UK general election to occur in Autumn 2023. Opposition leader Keir Starmer has a commanding lead in the polls and is the strong favourite to be the next prime minister. The number of seats Labour must win means it could land anywhere between a minority government and the landslide to which opinion polls currently point. With the Conservatives bitterly divided, it is extremely hard to see how Rishi Sunak can recover enough support to hold on to power.

OUTLOOK

Market sentiment oscillated wildly during 2023, starting with concerns about recession at the outset of the year, before shifting to optimism about economic resilience in the summer, contrasting views on ‘higher-for-longer’ in the autumn, and finally euphoria about the prospect of future interest rates in the final quarter. With interest rates set to fall, and the prospect of a ‘soft economic landing’ looking more likely, we are cautiously optimistic about the outlook for risk assets in 2024.

The recent rally across equities and bonds has pushed valuations to challenging levels in certain regions and sectors. Despite this, we see pockets of value and opportunities across stocks, fixed income and private markets.

We have been gradually reducing our underweight to equities in recent months, while avoiding regions and sectors that look priced for perfection. UK equities are looking increasingly attractive, as a lowly valued market, which is set to finally benefit from a period of relative political stability. There are also pockets of better value in the US outside of megacap technology names. We are seeing opportunities in US midcaps and cyclical stocks that should benefit from the benign economic outlook. We are also considering selective exposure to emerging markets, particularly those stocks that are less directly exposed to China and trade on historically low valuations.

In fixed income, we continue to add to duration and remain constructive on the outlook for real estate backed lending as an opportunity to generate attractive returns and consistent, inflation-protected income streams.

Our Private Markets Investment team continue to unearth interesting opportunities to deploy capital, including recent direct investments into ABSL and an innovative music technology startup. For the year ahead, we are excited to explore opportunities in women’s health, AI, biotech and the entertainment space.