Market Update February 2024

4 March 2024

Sign up to our newsletter for regular insights from the Hundle team.

Global equity markets continued to strengthen in February, with both Developed Markets and Emerging Markets participating in the rally. Several indices set new all-time highs, including the MSCI World Index, S&P 500, Nasdaq, Stoxx Europe 600 and Nikkei. Strong corporate earnings growth and resilient economic data, especially in the US, boosted investor sentiment and offset the disappointment of dampened interest rate cut expectations.

In contrast to equities, government bond markets weakened for the second successive month as bond yields rose. Hopes of near-term interest rate cuts have been dashed, with global central banks finding too many reasons not to cut rates at this point. January policy meeting minutes from the US Federal Reserve, European Central Bak and the Bank of England indicated a greater reluctance to ease policy currently, although the message remains that rate cuts can be expected later in the year. Policymakers want to see inflation falling sustainably towards target levels.

In client portfolios, we have been gradually adding to our equity exposure. Our outlook for Japanese equities remains positive, driven by improving corporate governance, an abundance of high-quality businesses trading at attractive valuations, and an improving economic picture. Our investment team have also been reviewing opportunities to add to our Emerging Markets weighting. We are particularly interested in Indian equities due to strong corporate earnings growth; a stable and pro-business government; and accelerating consumer spending supporting economic growth. We are mindful that both Japan and India have enjoyed a period of impressive stock market performance, however we think that valuations still look reasonable in the context of the positive medium to long-term structural tailwinds that both markets benefit from.

US

All major US indices hit new highs during February. The technology sector was once again pivotal in driving the market higher on strong corporate earnings, notably AI-chip producer Nvidia. With over 90% of S&P 500 firms having reported, nearly three quarters have beaten analysts’ earnings forecasts.

US headline inflation fell to 3.1% in January but was higher than forecast. Economic data, including wages, unemployment, and non-farm payrolls, all pointed to a continued tight labour market. PMI data was also strong, indicating that US growth remains resilient. Fed fund futures now indicate approximately 75 basis points of easing this year, compared with 125-150 basis points at the start of the year.

February saw US corporate borrowers tapping the market for record amounts. Investment-grade borrowers raised $153bn, a record level for the month. Corporate bond yield spreads continued to contract, and US high yield has gained 0.3% over the first two months of 2024.

In currencies, the US dollar index hit a 3-month high mid-month before falling back to end only marginally higher. The dollar remains supported by strong US economic growth and delays to interest rate cuts.

—

EUROPE

The UK fell into a technical recession, with fourth-quarter GDP coming it at –0.3% quarter-on-quarter following the third quarter’s figure of -0.1%. However, retail, PMI and employment data have improved at the start of this year, so we expect that a recession may be short-lived. Inflation remained unchanged at 4%, which was better than expected.

UK stocks continue to lag, with the FTSE All-Share down 1.1% year-to-date. Sterling was unchanged against the USD but fell marginally against the euro. Our investment team remain positive about the medium to long-term outlook for the UK equity market. After a period of sustained weakness, valuations look attractive and we anticipate that some long-overdue political stability will be supportive of domestic UK stocks.

European equity markets underperformed on a relative basis during February. There was limited economic news from Europe, however PMI data came in better than expected. The euro was marginally stronger against other major currencies.

—

ASIA

The Nikkei rose above 39,000, establishing its first new high for over 34 years. Strong corporate earnings (driven partly by a weaker yen) have been key to this. The Japanese economy, however, fell back into recession, down 0.1% quarter-on-quarter in Q4, after an 0.8% decline in Q3. The yen weakened back above 150 against the US dollar, putting pressure back on the Bank of Japan to potentially intervene in currency markets to support the yen.

China’s Shanghai Composite index hit a 5-year low early in February before recovering on the back of greater stimulus measures from the Chinese government, including a cut to mortgage borrowing rates. The yuan weakened mildly against the USD in response to lower rates.

As part of a wider review of Emerging Markets, our investment team have been assessing the opportunities in Chinese equities. Despite valuations looking compelling, we have opted not to invest at this stage due to concerns about weak corporate governance, geopolitical uncertainty, and ongoing concerns about the Chinese property sector.

—

COMMODITIES

Commodities were down for the month, with the broad Bloomberg Commodity index declining by 1.5%. Oil prices increased as fighting in the Red Sea continued to disrupt shipping. OPEC raised its global demand outlook for 2024 and 2025 by approximately 2 million barrels per day. US crude inventories remain high.

Industrial metals including copper, zinc and aluminum were all weaker in February, largely on concerns about lackluster Chinese demand. Iron ore has also fallen materially over the month due to worries about the China construction market.

Gold traded sideways in February. It fell initially on concerns about the higher US dollar, with rate cuts being postponed, before recovering.

OUTLOOK

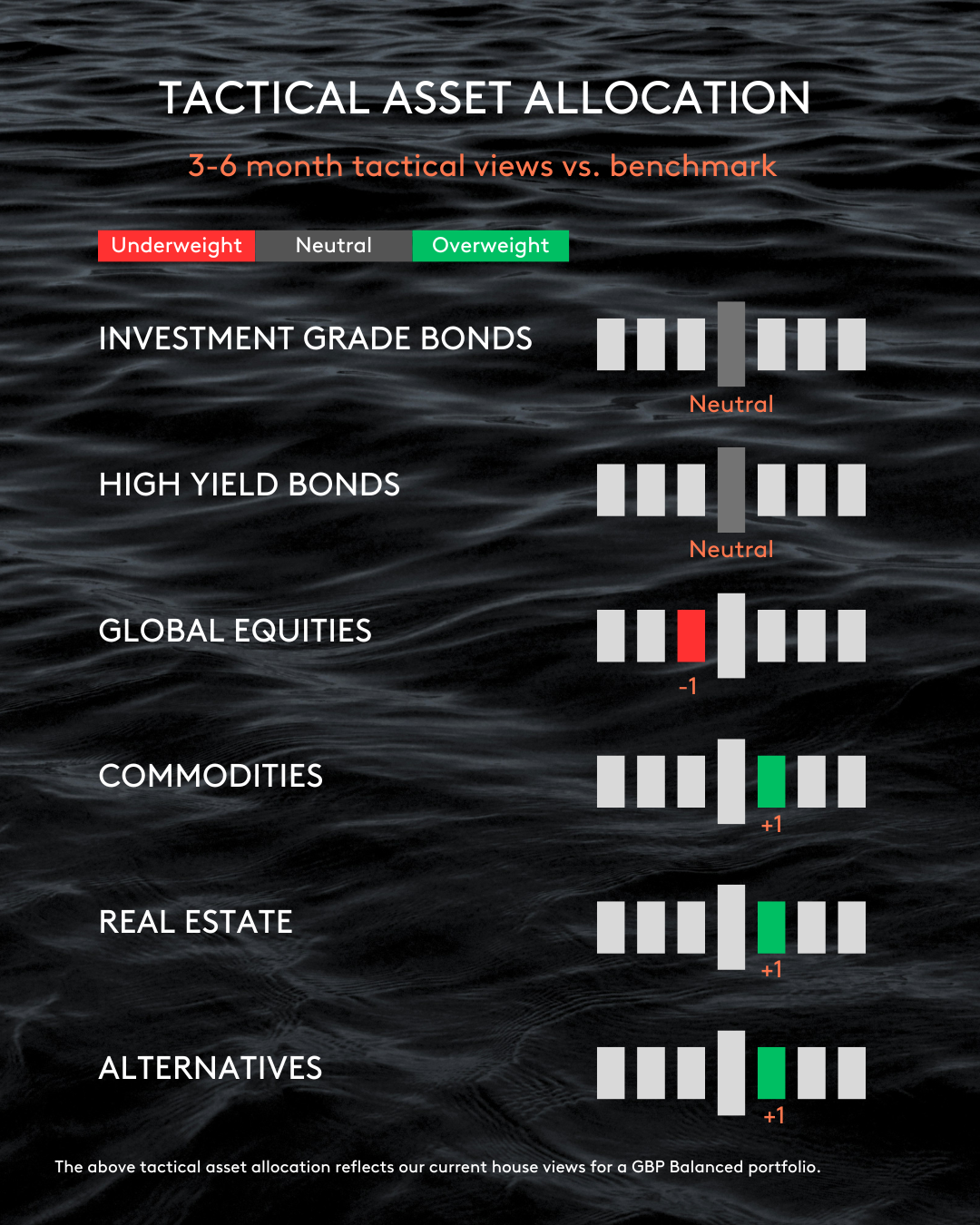

The US economy continues to outperform, and we see little evidence to suggest that this positive trend will reverse any time soon. A ‘soft’ economic landing in the US is now our base case and we believe this will be supportive of global equities. Although the exact timing of interest rate cuts is uncertain, it is highly likely that both monetary and fiscal policy will help to drive equities higher in 2024, particularly as we move closer towards the US election. Against this backdrop, we are comfortable increasing our equity exposure, but retain a strong preference for regions and sectors that offer quality at a reasonable price.

Outside of public market equities, our private market team is seeing a sharp increase in distressed companies seeking emergency financing. These situations allow us to buy claims on assets at bargain prices, and we aim to achieve substantial gains for our investors by actively participating in restructurings to restore companies to financial viability.