Mid-Year Market Update

11 July 2024

Sign up to our newsletter for regular insights from the Hundle team.

As we pass the midpoint of 2024, global financial markets have shown remarkable resilience amidst a backdrop of persistent inflation, geopolitical tensions, and fluctuating economic policies. Despite forecasts of rapidly falling inflation and subsequent rate cuts by central banks, the global economy has remained robust, defying initial projections. This update provides a review of market performance in Q2 and looks ahead to the second half of the year.

WHAT HAPPENED TO MARKETS DURING Q2?

EQUITY MARKETS

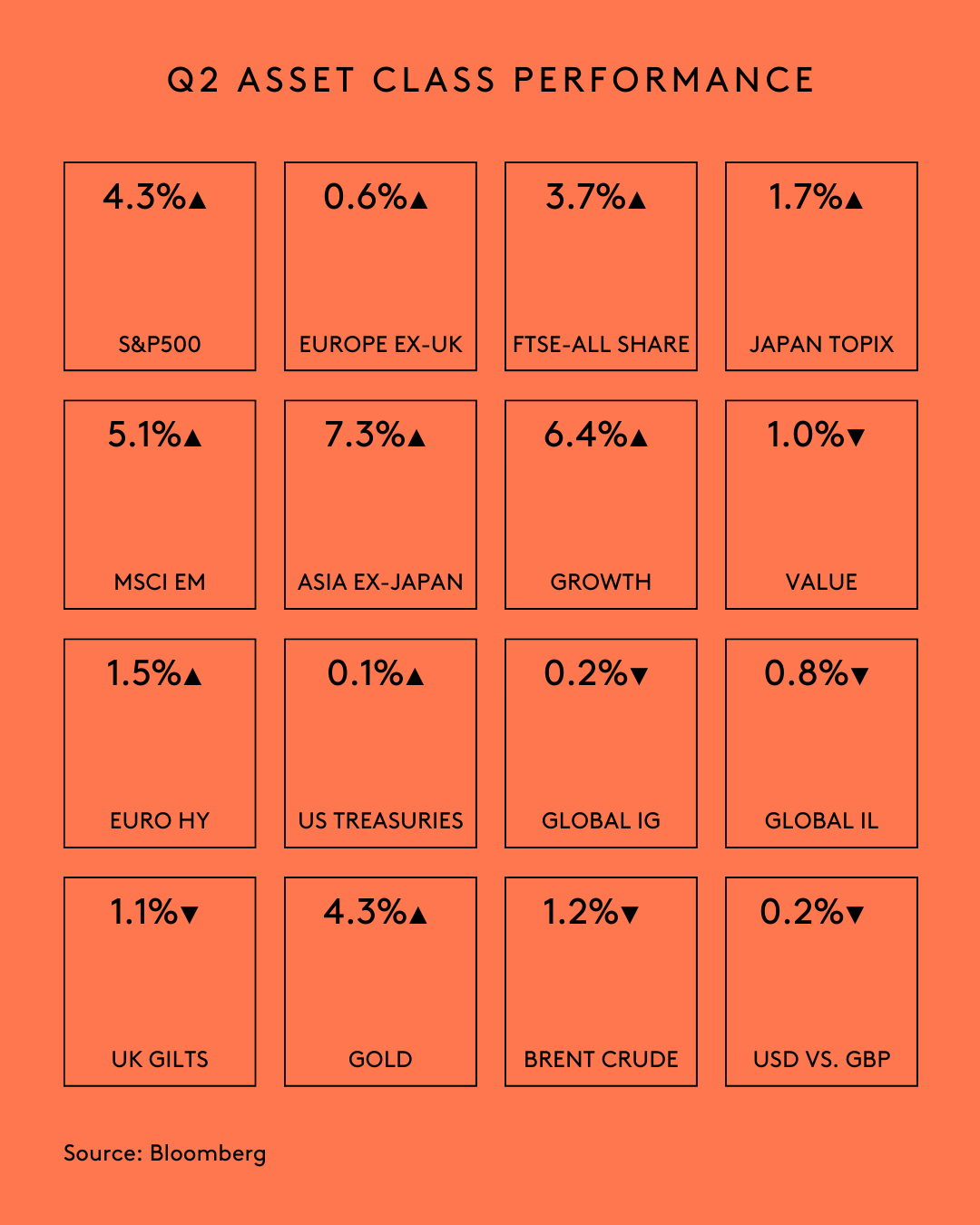

Equity markets experienced another period of growth in Q2 2024, driven by continued economic expansion and positive investor sentiment. Developed market equities posted a total return of 2.8% for the quarter. The performance was particularly strong among large-cap companies, while rate-sensitive small-cap faced challenges due to the higher-for-longer interest rate environment.

In the United States, the tech sector, bolstered by strong earnings and significant contributions from companies involved in artificial intelligence, led growth stocks to a notable quarterly return of 6.4%. This surge in ‘growth’ was primarily concentrated in the US, while in Europe, Japan, and the UK, value stocks outperformed their growth counterparts.

Asian markets, particularly those exposed to artificial intelligence, performed robustly. Chinese authorities’ measures to support the real estate sector and strong performance from Taiwan’s AI-exposed stock market helped Asia ex-Japan equities achieve a strong return of 7.3%. This performance lifted the broader emerging markets, which outpaced developed markets with a 5.1% return for the quarter.

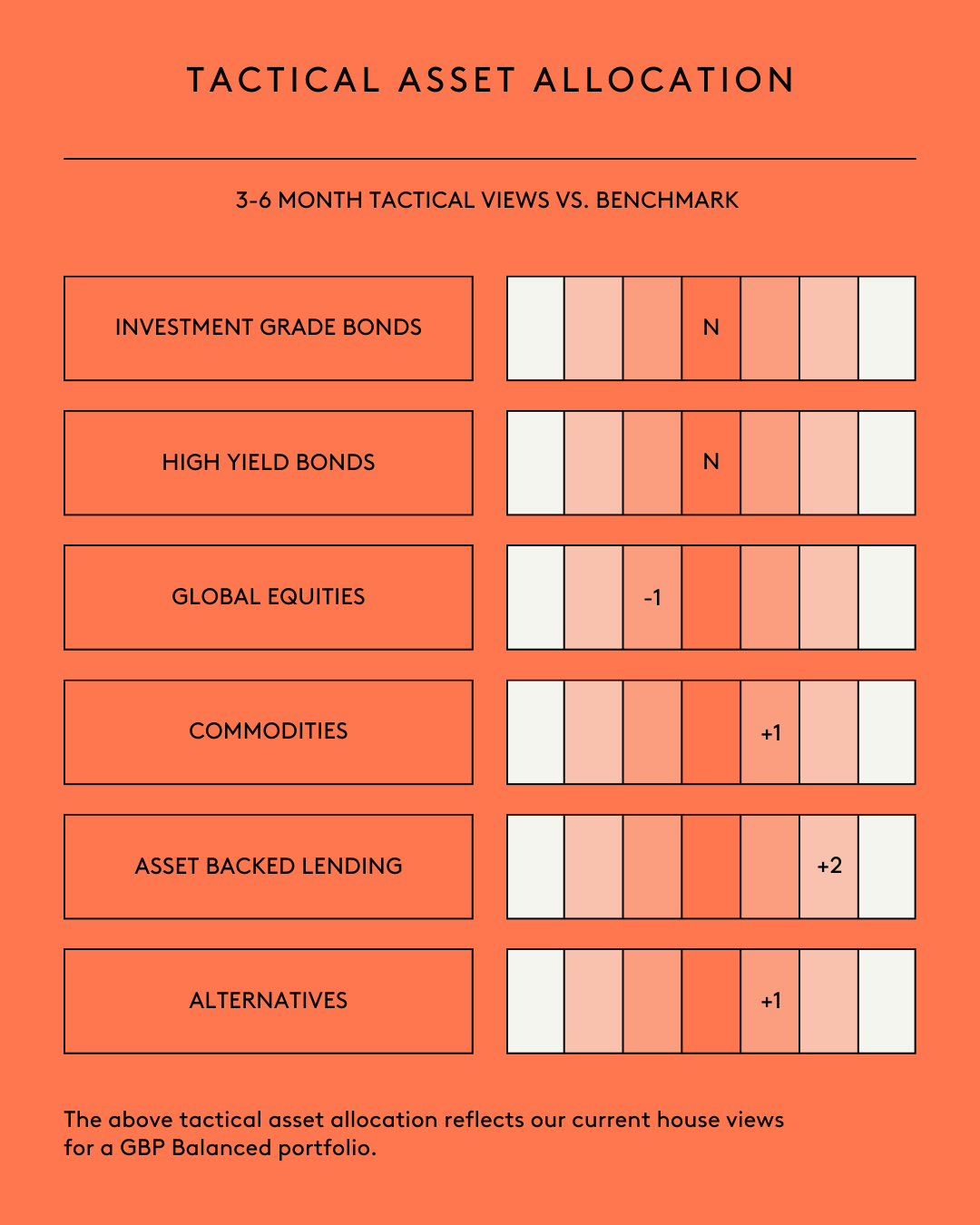

Year to date, we have been underweight equities in client portfolios and have favoured geographical regions where valuations look less stretched. Looking forward, we are more positive on the outlook for domestically focused UK stocks and have started to see early signs that investor sentiment towards the UK is shifting in the right direction.

—

FIXED INCOME

Fixed income market faced headwinds, with global investment-grade bonds delivering negative returns of -0.2% for the quarter. The persistent inflationary pressures, especially in the services sector, kept central banks cautious, leading to fewer anticipated rate cuts. US Treasuries managed a marginally positive return of 0.1% over the quarter, driven by softer economic data from early May and slightly more hopeful investor sentiment regarding potential policy easing by the Federal Reserve.

—

ECONOMY & CENTRAL BANKS

The US economy displayed resilience, although economic data softened after a strong April. The Federal Reserve’s hawkish stance in June, removing all but one rate cut from its 2024 projections, contrasted with market expectations of two cuts by year-end. Despite this, Treasury yields remained stable, reflecting a more sanguine investor outlook.

The European Central Bank cut interest rates in June; a move anticipated by the market. However, stickier-than-expected inflation and political uncertainties, particularly following the European parliamentary elections and President Macron’s announcement of snap elections in France, introduced volatility. Consequently, European government bonds experienced negative returns, and the broader European equity market delivered a modest return of 0.6%.

—

POLITICS: THE GOOD, THE BAD & THE UGLY

UK ELECTION

As we wrote recently, the UK election saw a significant shift in the political landscape, with Sir Keir Starmer’s Labour Party winning a substantial parliamentary majority despite securing only 34% of the popular vote. This outcome reflects the electorate’s discontent with the Conservative Party, which suffered a dramatic loss of support compared to its 2019 victory.

Starmer’s Labour faces the dual challenge of delivering effective governance while restoring public trust. The economic environment remains challenging, marked by the long-term impacts of Brexit, the COVID-19 pandemic, and the ongoing cost-of-living crisis. Labour’s cautious approach, promising improvements without radical changes, has raised concerns about its ability to meet public expectations and drive substantial economic recovery.

One of the immediate priorities for the new government will be addressing the funding and efficiency of public services, particularly the National Health Service and local governments. Achieving this in a stagnant economy without significant borrowing or tax increases will be difficult. The hope is that political stability and gradual economic recovery will facilitate progress, but there are significant uncertainties.

Labour’s strategy must include measures to enhance economic growth, such as closer ties with the EU, liberalising planning regulations, supporting innovation, decentralising power, and reforming the tax system. Addressing these issues will require bold steps and may necessitate breaking some pre-election promises, potentially further eroding public trust. The challenge for Starmer is to navigate these complexities and deliver tangible improvements, ensuring Labour’s position in power is not short-lived.

—

FRENCH ELECTION

The French snap elections introduced significant volatility to European markets, with President Emmanuel Macron’s centrist Ensemble alliance performing better than expected but still falling short of a majority. The election saw the leftist Nouveau Front Populaire (NFP) emerging as the largest bloc with 182 seats, followed by Macron’s alliance with 168 seats. Marine Le Pen’s far-right Rassemblement National (RN) party, which had hoped for a substantial victory, secured 143 seats, landing in third place.

Macron’s gamble on a snap election was intended to clarify the political landscape but resulted in a hung parliament, creating a complex and uncertain political environment. The NFP, led by Jean-Luc Mélenchon, has called for the formation of a government from their ranks, advocating for high-spending policies and significant tax increases, which has raised concerns among investors. Despite these political challenges, French stocks and the euro showed resilience, with the CAC 40 index and broader European indices recovering after initial declines.

Macron’s centrist coalition is expected to seek alliances with moderate forces, such as the Socialists and Greens, to stabilise governance. However, the market remains wary of the potential for increased government spending and its implications for France’s fiscal stability.

—

US ELECTION

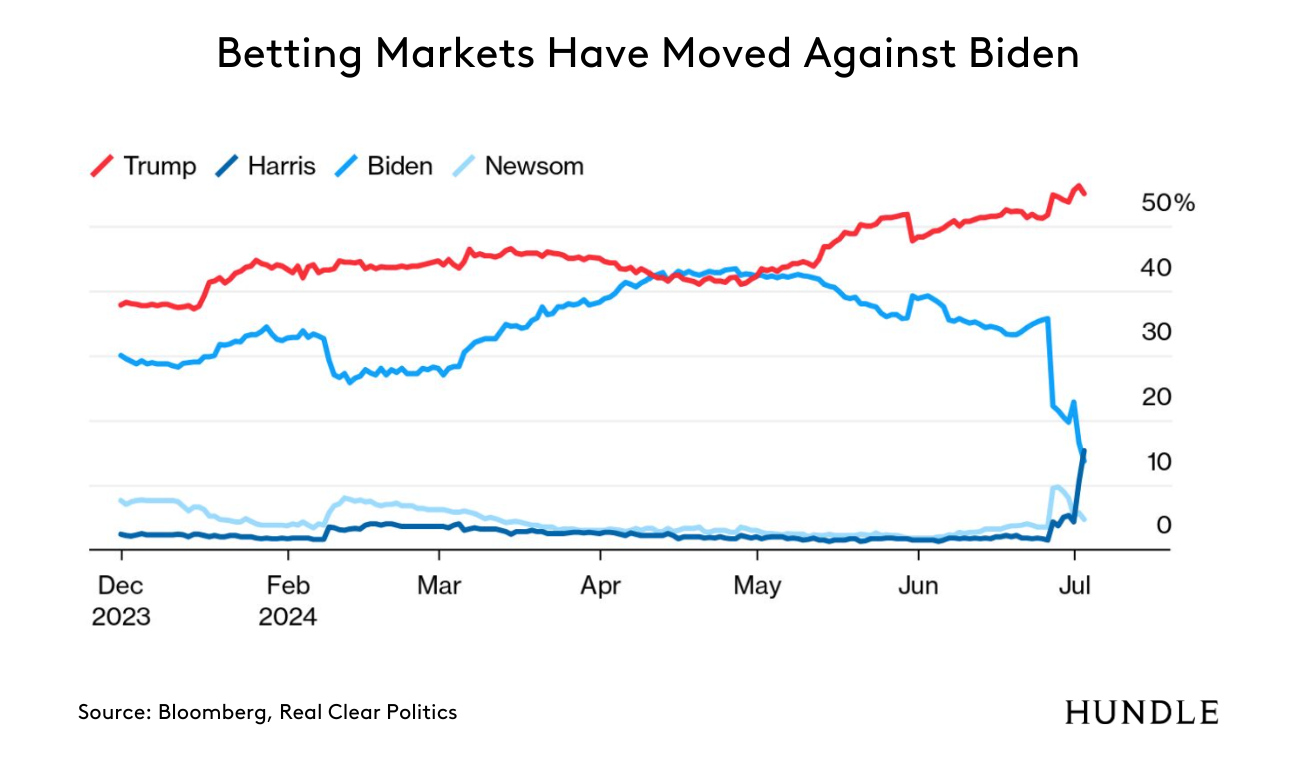

The upcoming US presidential election has taken a dramatic turn following President Joe Biden’s poor performance in the first debate against former President Donald Trump on June 27. Biden’s debate performance, marked by frequent lapses in memory, confusion over policy details, and a generally disoriented demeanour, has intensified concerns about his age and cognitive abilities. At 81, Biden’s capacity to effectively lead for another term is increasingly questioned by both voters and members of his own party.

The debate debacle has led to a significant drop in Biden’s poll numbers, with Trump now leading in key battleground states such as Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania, and Wisconsin. The aftermath of the debate saw two-thirds of voters expressing a preference for Biden to be replaced as the Democratic candidate before the November election.

The White House has attributed Biden’s performance to a “cold” and exhaustion, while prominent Democrats, including former President Barack Obama and former Secretary of State Hillary Clinton, have publicly supported Biden. Despite these endorsements and a reported surge in fundraising following the debate, there is mounting pressure within the Democratic Party for Biden to step down. Influential donors and party operatives are actively seeking alternative candidates, with Vice President Kamala Harris, Michigan Governor Gretchen Whitmer, and California Governor Gavin Newsom among the potential replacements.

The fallout from Biden’s debate performance has exposed deep divisions within the Democratic Party. Some members publicly calling for his resignation while others remain loyal. The internal discord and the potential for a contentious nomination process add to the uncertainty surrounding the Democratic campaign.

Biden’s path forward will be closely scrutinised, particularly during unscripted public appearances. His ability to demonstrate competence without reliance on teleprompters will be critical. As the campaign progresses, the pressure from both within the party and from Trump’s aggressive campaign tactics will shape the dynamics of the race.

OUTLOOK: WHAT DO WE EXPECT IN H2?

As we look towards the second half of 2024, the investment landscape presents both opportunities and challenges. The global economy continues to exhibit strength despite ongoing inflationary pressures and geopolitical risks.

We have turned cautiously optimistic about the outlook for equity markets. Despite the high inflation environment, companies have managed to maintain robust profit margins. High-single-digit earnings growth, particularly in sectors like technology, healthcare, and consumer discretionary, is expected to push markets to new highs through the end of 2024 and beyond. Japanese equities are particularly attractive due to their improving shareholder practices and economic reforms.

We have noted previously that we are actively considering adding to our UK exposure. The UK’s recent political stabilisation provides a robust foundation for economic growth and investment, offering predictability and strategic alignment with key European partners. This contrasts favourably with the political uncertainty seen in both the US and Europe.

Alternative investments, including asset backed lending, continue to provide inflation protection and uncorrelated income, and play a vital role in our client portfolios.

While the world navigates economic and geopolitical uncertainties, a well-diversified, long-term investment strategy focusing on resilient asset classes can help investors harness opportunities and mitigate risks in the second half of 2024 and beyond. We remain committed to guiding our clients through this dynamic environment, leveraging our expertise to optimise investment outcomes.