Monthly Investment Update

5 September 2024

Sign up to our newsletter for regular insights from the Hundle team.

August has been a month of heightened volatility across global markets, marked by a sharp sell-off early on, followed by a recovery driven by changing expectations around US monetary policy. This turbulence, however, has provided valuable insight into the current state of various asset classes and regions, shaping how we position portfolios for the months ahead. In this update, we’ll explore the recent market developments, our key investment themes, and opportunities, particularly in UK equities, private credit, commodities, and private market investments.

A VOLATILE SUMMER

The volatility that defined August started with an abrupt sell-off in global equities. As discussed in our recent article “Navigating the Storm: Volatility in Japan”, the catalyst was twofold: disappointing US economic data and unexpected monetary tightening from the Bank of Japan. The BoJ’s decision to raise interest rates by 25 basis points, coupled with Governor Ueda’s hawkish tone, led to a stronger yen and an unwinding of the carry trades that had relied on cheap yen borrowing. Investors swiftly shifted out of riskier assets, causing global equity markets to drop sharply.

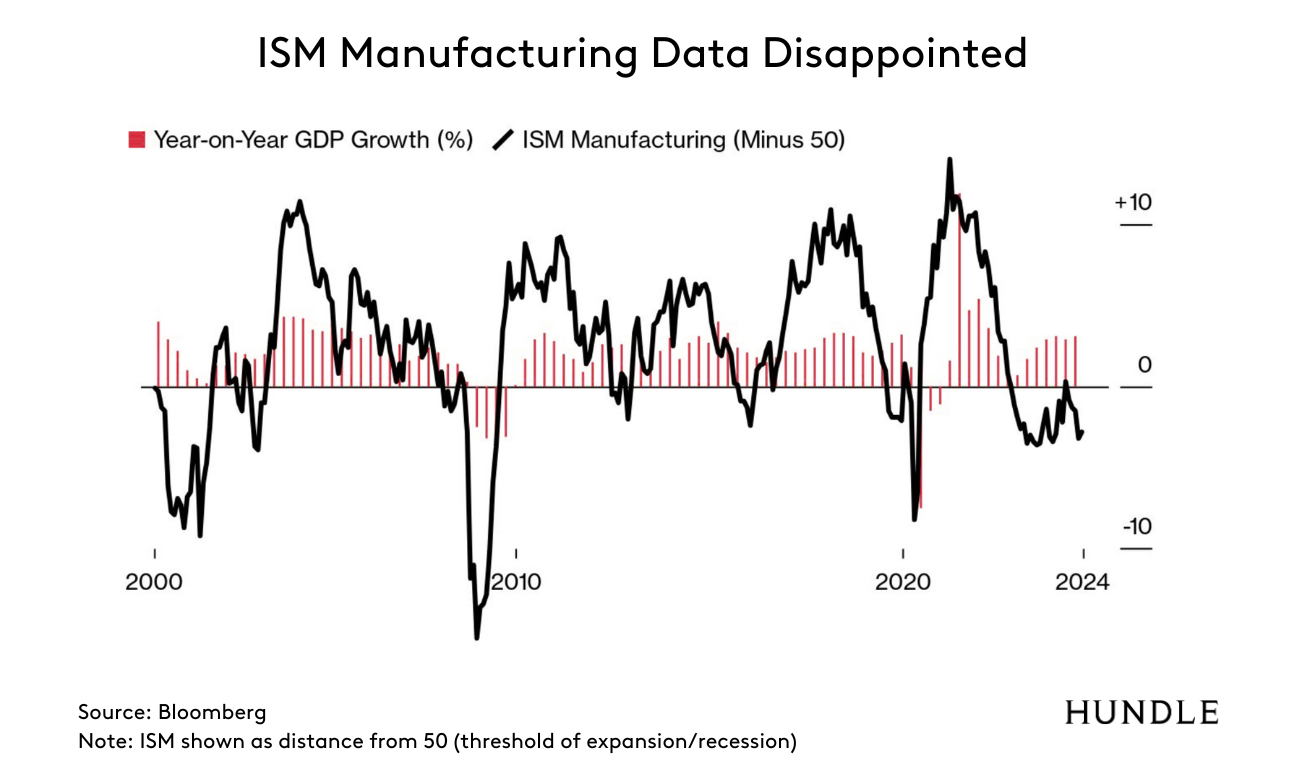

The US markets also contributed to the broader sell-off. A weaker-than-expected ISM manufacturing print and a disappointing July jobs report, which showed the smallest payroll increase in over three years, fuelled concerns about an economic slowdown. The unemployment rate rose to 4.3%, and fears of recession mounted. However, by mid-month, markets found their footing again, driven by growing expectations of policy easing from the US Federal Reserve. As investors began to price in potential rate cuts, equity markets recovered, with the S&P 500 closing August 2.4% higher.

OUTLOOK FOR EQUITIES

While we remain underweight global equities overall, we continue to view UK and Japanese equities with optimism, even amidst global uncertainty. Our positive stance is underpinned by several key factors, including attractive valuations, strong corporate balance sheets, and political and monetary developments that are supportive of these markets.

UK EQUITIES

The UK’s political landscape is increasingly important in shaping the outlook for equities. There is growing optimism that a Labour-led government could bring about much-needed fiscal reforms, focusing on infrastructure, green energy, and revitalising public services. These reforms could stimulate domestic demand, improving business confidence and enhancing the growth outlook for UK companies.

Valuations in the UK remain appealing compared to global peers, particularly US large-cap equities, which continue to trade at historically high multiples. We see UK companies, especially in sectors like financials, energy, and industrials, as offering strong return potential, bolstered by attractive dividend yields. Furthermore, the UK market’s sensitivity to global growth, combined with a stable regulatory and political environment, positions it well for investors seeking value in an uncertain global landscape.

JAPANESE EQUITIES

In addition to our positive outlook on the UK, we remain bullish on Japanese equities. Recent developments in Japan present a compelling opportunity for long-term investors. Japan’s corporate governance reforms, designed to increase transparency and improve shareholder returns, have already led to a more dynamic corporate environment. Japanese firms are now showing stronger earnings potential, with a focus on shareholder value that has historically been lacking.

Moreover, the Bank of Japan’s gradual exit from its ultra-loose monetary policy, including moving away from negative interest rates, marks a significant shift for the country’s financial markets. As noted in our insights, the BoJ’s decision to raise rates is part of a broader move towards normalising its monetary stance, following decades of aggressive stimulus. While this has introduced short-term volatility, it is a long-term positive for Japanese equities, as it indicates growing confidence in the domestic economy.

Although the yen has rallied in recent weeks, it remains historically weak which supports export-driven sectors like manufacturing and technology. Coupled with relatively attractive valuations compared to global markets, Japan’s equities offer a favourable risk-reward balance. We believe that the combination of these factors makes Japan an attractive destination for investors looking to diversify their equity exposure away from the US and other overvalued markets.

—

COMMODITIES & GOLD

The commodity market, in contrast to the broader equity recovery, has faced ongoing challenges. Weak global growth, particularly in China, has weighed heavily on demand for key raw materials. Oil prices declined in August amid concerns over sluggish demand, and iron ore prices hit a two-year low, driven by ongoing issues in China’s real estate sector.

However, gold emerged as a bright spot within the commodity space. Gold prices rallied in August, supported by continued economic uncertainty and geopolitical tensions. Investors sought safety in gold, which benefited from the broader market volatility and declining real yields. By the end of the month, gold prices were trading near record highs, reinforcing its status as a safe-haven asset in times of market stress.

While we do not currently hold direct exposure to gold in our portfolios, we are actively considering gold as a hedge within client portfolios. As market uncertainty continues and the US dollar weakens with expected Federal Reserve rate cuts, gold could offer a valuable hedge against a return of inflation and currency devaluation. We are monitoring gold closely and will consider incorporating it strategically should conditions continue to evolve in a way that supports its safe-haven appeal.

FIXED INCOME & PRIVATE CREDIT

Fixed income markets had a strong month in August, buoyed by expectations of future rate cuts from major central banks. The Bloomberg Global Aggregate Index posted a gain of 2.4%, driven by a drop in yields across developed markets. US Treasuries outperformed other sovereign bonds, returning 1.3%, as the market priced in more aggressive rate cuts by the Fed.

Within the broader fixed income landscape, we maintain a strong preference for private credit and asset-backed lending opportunities. These areas continue to offer attractive risk-adjusted returns in the current low-yield environment. Private credit provides exposure to higher yields with less volatility than traditional public fixed income markets. Asset-backed lending also remains a key focus, as these opportunities are supported by strong collateral and predictable cash flows.

Given the current market environment, where equity valuations remain stretched and interest rates are expected to decline, private credit and asset-backed lending present compelling alternatives to traditional fixed income and equities. These strategies offer both income generation and capital preservation, helping to balance risk and return within portfolios.

—

DIRECT INVESTMENTS

Our private market investments continue to play an essential role in providing diversified, long-term growth across client portfolios. At Hundle, we source and evaluate opportunities across private equity, credit, hedge funds, and venture capital, which allows us to offer bespoke alternatives to public market exposure. Our in-house alternative investments team carefully selects these opportunities, backing management teams with strong track records and a clear execution edge.

Key highlights from our private market portfolio in Q2 2024 include:

➤ F1 Arcade: The company successfully raised $130 million in debt funding, allowing management to focus on expansion, with new sites planned across the US, including Boston and Washington, D.C. The business is targeting an exit for early investors in 2026.

➤ BREOL: Our £8 million joint venture investment in a premium residential land development in Gdańsk, Poland, continues to progress. We are evaluating a preliminary buyout offer, with a potential exit by Q4 2024.

➤ ABSL: ABSL’s innovative ‘RadGas’ technology, which converts waste into biofuels, has attracted interest from strategic power and utility companies. The business is exploring exit options that could materialise in the next 3-6 months.

➤ Afunder: Our clients have accessed Afunder through our asset-backed lending strategy, providing loans to small UK-based companies. This opportunity offers an annual fixed coupon of 12% with a default rate of less than 2.5%.

Looking ahead, we continue to assess new opportunities, including investments in US corporate liabilities, sports franchises, and luxury goods lending. These investments, alongside our existing portfolio, are key to achieving diversified returns and navigating market volatility over the long term.

—

OUTLOOK

August’s market movements have reaffirmed our cautious stance on global equities, particularly in the US, where high valuations pose a significant risk in a slowing growth environment. As we navigate the remainder of the year, we will continue to monitor the evolving economic and political landscape, ensuring that client portfolios are well-positioned to capture opportunities and mitigate risks. While the outlook remains challenging, our focus on value-driven investments, private credit, and private market opportunities provides a balanced approach to delivering risk-adjusted returns for our clients.