Navigating The Storm: Volatility In Japan

8 August 2024

Sign up to our newsletter for regular insights from the Hundle team.

KEY TAKEAWAYS

- Japanese equity markets experienced significant volatility this week due to concerns about the US economy and the BOJ’s decision to raise interest rates.

- Tighter monetary policy resulted in a sharp rally in the yen, which was exacerbated by the unwinding of carry trades. In response, Japanese equities endured their worst day since 1987 before partially recovering as the week progressed.

- Despite short-term volatility, we remain positive on the longer term outlook for Japanese equities. This view is underpinned by the improving economic picture, corporate governance reforms, favourable investment flows, and attractive valuations.

—

WHAT’S HAPPENED?

This summer has been turbulent for global markets, and Japan has been in the eye of the storm. The spark was the unexpectedly soft US jobs report in July, which sent shockwaves through international financial markets. Japanese equities were hit particularly hard, experiencing their most severe sell-off since the 1987 crash. This was a stark reminder of how intertwined global economies are; when the US sneezes, the rest of the world catches a cold.

At the same time, the Bank of Japan has been gradually moving away from its long-held stance of negative interest rates. This year, it commenced a gradual tightening, a move aimed at normalising the yield curve and eventually raising short-term interest rates. For an economy that has grappled with deflation for decades, this shift marks a significant policy turn.

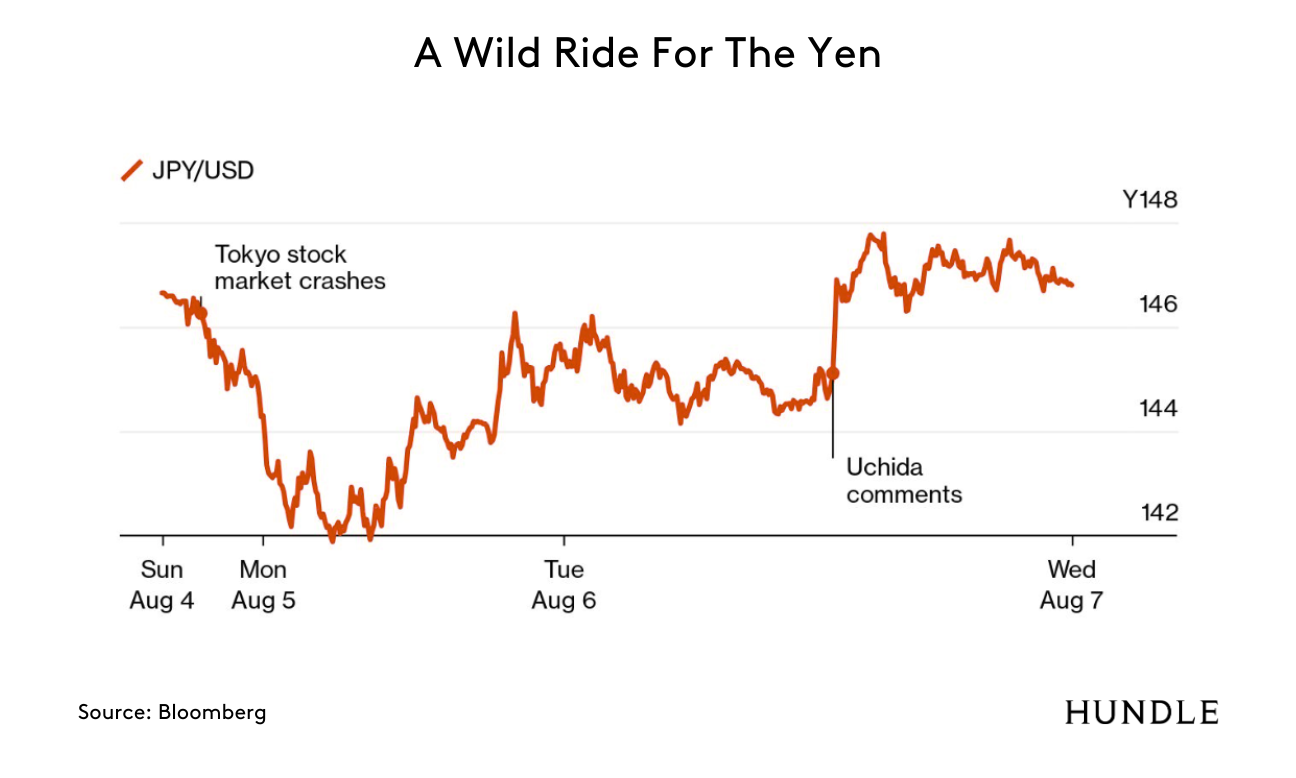

The repercussions of this policy change have been multifaceted. Firstly, the yen has appreciated markedly against the dollar over the past fortnight, reversing a trend of significant depreciation. The narrowing interest rate differential between the US and Japan—from 3.43% in June to 2.99%—has been a key driver of this currency strength. This appreciation has made Japanese exports more expensive and less competitive globally, adding another layer of complexity to the market’s response.

Moreover, the yen’s volatility has been exacerbated by the unwinding of carry trades. Investors had borrowed in yen, a low-interest currency, to invest in higher-yielding assets elsewhere. As Japanese rates rose and the yen strengthened, these trades became less attractive, leading to a rapid unwinding that further fuelled market instability.

On Wednesday, Deputy BOJ Governor Shinichi Uchida intervened to sooth markets when he stated that “the bank needs to maintain monetary easing with the current policy interest rate for the time being, with…financial and capital markets at home and abroad being extremely volatile.” These dovish comments have brought the yen/dollar back to where it had started the week.

REASONS FOR OPTIMISM?

Despite the short-term turbulence, the fundamental case for Japanese equities remains compelling. Several structural shifts are transforming Japan’s economic landscape, paving the way for sustained growth and enhanced investor confidence.

POSITIVE ECONOMIC INDICATORS

Japan is experiencing a welcome period of positive nominal growth after years of battling deflation. Inflation has returned, driven by higher consumer prices and wage growth, creating a virtuous cycle that should bolsters domestic demand. This resurgence in consumer spending is particularly beneficial for domestically oriented companies, and should be supportive of revenue growth.

Additionally, the BOJ’s policy normalisation is expected to breathe new life into Japanese financial stocks – a key constituent of the Japanese equity market. The transition to positive interest rates will enable banks to earn more on excess reserves and charge higher rates on loans, enhancing their profitability.

CORPORATE GOVERNANCE REFORMS

Another pivotal development is the wave of corporate governance reforms sweeping across Japan. Historically, Japanese companies have been criticised for their lack of focus on shareholder value, with many firms holding excessive cash reserves. However, this is changing. The Tokyo Stock Exchange’s recent mandate requiring companies with a price-to-book ratio below one to develop plans to boost shareholder returns or face delisting has sparked a surge in share buybacks and other shareholder-friendly actions.

This renewed emphasis on corporate efficiency and investor returns is transforming Japan’s corporate landscape. As companies become more agile and responsive to shareholder demands, they are likely to deliver better performance and higher returns, making Japanese equities more attractive on the global stage.

SHIFTS IN GLOBAL INVESTMENT FLOWS

Global geopolitical shifts are also playing in Japan’s favour. With rising US-China tensions and performance issues in Chinese markets, international investors are increasingly redirecting their capital towards Japan and India. This diversification away from China is enhancing Japan’s appeal as a stable and promising investment destination.

ATTRACTIVE VALUATIONS

From a valuation perspective, Japanese equities present a compelling case. The price-to-earnings (P/E) multiples have contracted, moving from 15x to 12x, which is below the 10-year average. This relative undervaluation, combined with anticipated earnings growth, offers an interesting opportunity for long-term investors.

—

LOOKING AHEAD: HAS OUR VIEW ON JAPAN CHANGED?

While recent volatility in Japanese equity markets is unwelcome, it is important to contextualise these fluctuations within the broader scope of global economic dynamics and local policy changes. The underlying fundamentals of Japan’s equity market are strong, supported by positive nominal growth, significant corporate governance reforms, and attractive valuations. Despite this period of turbulence, we continue to believe that Japan is a market poised for long-term growth and we remain invested.