Nikkei at 39,000 - What next for Japanese equities?

23 February 2024

Sign up to our newsletter for regular insights from the Hundle team.

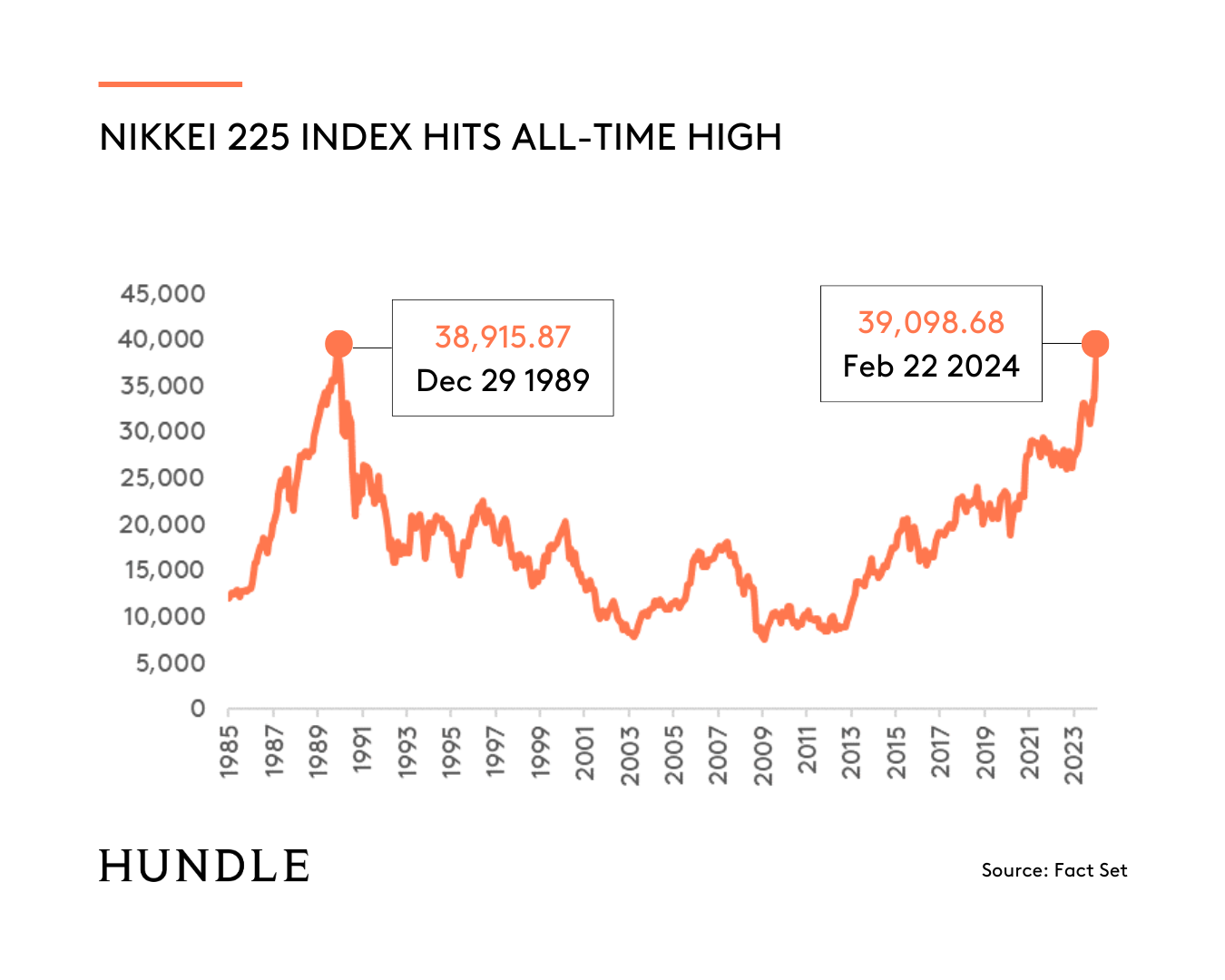

The Nikkei 225 has reached a new record high for the first time since December 1989. The index of the biggest Japanese companies closed above 39,000 and is now up 17.5% since the start of the year. Despite this, investors are cautiously optimistic rather than euphoric. Debt levels remain staggeringly high, GDP growth has contracted for two consecutive quarters, and Japan has only just emerged from years of painful deflation. So, why are the Hundle investment team positive about the medium-term outlook for Japanese equities?

CORPORATE GOVERNANCE REFORMS

One of the key factors underpinning our positive stance on Japanese equities is the ongoing wave of corporate governance reforms. The Tokyo Stock Exchange has played a proactive role in incentivising Japanese companies to utilise their capital more efficiently. The exchange asked companies that are trading under their book value to publish plans “as soon as possible” on lifting their stock prices and specifically called for better balance sheet management as many companies hoarded cash over the past decade.

This strategic move involves the unwinding of cross-shareholdings and a commitment to returning cash to shareholders through buybacks. Cross-shareholdings have long been a characteristic feature of the Japanese corporate landscape, contributing to a lack of transparency and hindering effective decision-making. The unwinding of these cross-shareholdings not only fosters transparency but also frees up capital for companies to invest in growth or return to shareholders. The impact of these reforms is already evident, and we anticipate that this positive momentum will accelerate in the medium term.

—

HIGH-QUALITY BUSINESSES

Despite the impressive rally in equity markets, Japan remains home to many high-quality businesses, trading on reasonable valuations. The momentum for corporate earnings is strong and balance sheets are resilient. While the overall market has experienced significant appreciation, 37% of Nikkei members still trade below their book value. In theory, this means investors could make more money by selling off all the company’s assets than by keeping the business as a going concern. If companies are run correctly, and valuations normalise, then there should be significant share price upside for investors.

—

JAPANESE ECONOMY

The economic picture in Japan is also showing signs of improvement. The Bank of Japan is gradually edging closer to an exit from its ultra-loose monetary policy, signalling a shift in the economic paradigm. Wages are on an upward trajectory and prices have finally turned positive. While most other developed economies have been fighting to bring down high inflation, rising prices are welcome in Japan, where decades of exceptionally low inflation or deflation has dampened GDP growth.

Corporate confidence is bouncing back after a series of setbacks including the global financial crisis, premature increases in the value-added tax and the COVID-19 pandemic. The most recent Tankan survey of Japanese executives indicates that business conditions are positive, with the service sector reaching its highest level since the 1980s.

Japan’s ageing population has been a long-term concern for investors, with the average age now 48.9 and 29 per cent of the population over the age of 65. While a shrinking labour force presents an economic challenge, it has been a catalyst for Japan’s strength in automation and robotics technologies. These technologies drive increased labour productivity and help to tackle the labour shortages that affect almost every aspect of the economy.

As monetary policy normalises this year, it allows for a more organic and sustainable growth trajectory. This signals a maturing and self-sustaining economy that can drive corporate profitability and market performance over the long run.

REASONS FOR CAUTION

While our optimism for Japanese equities is grounded in solid fundamentals, we acknowledge that there are also potential headwinds. With the Nikkei at a record high, several factors warrant careful consideration:

1. High Debt Levels: Japan’s national debt levels remain staggeringly high, posing a long-term challenge to economic stability. The IMF (International Monetary Fund) estimates that the Japanese public debt to GDP ratio will reach 256 per cent this year. While efforts are being made to address this issue, it remains a persistent concern that could impact the trajectory of the equity market.

2. Deflation: Japan has only recently emerged from years of painful deflation. While the signs of recovery are promising, the lingering effects of deflation can cast a shadow on economic growth and market performance.

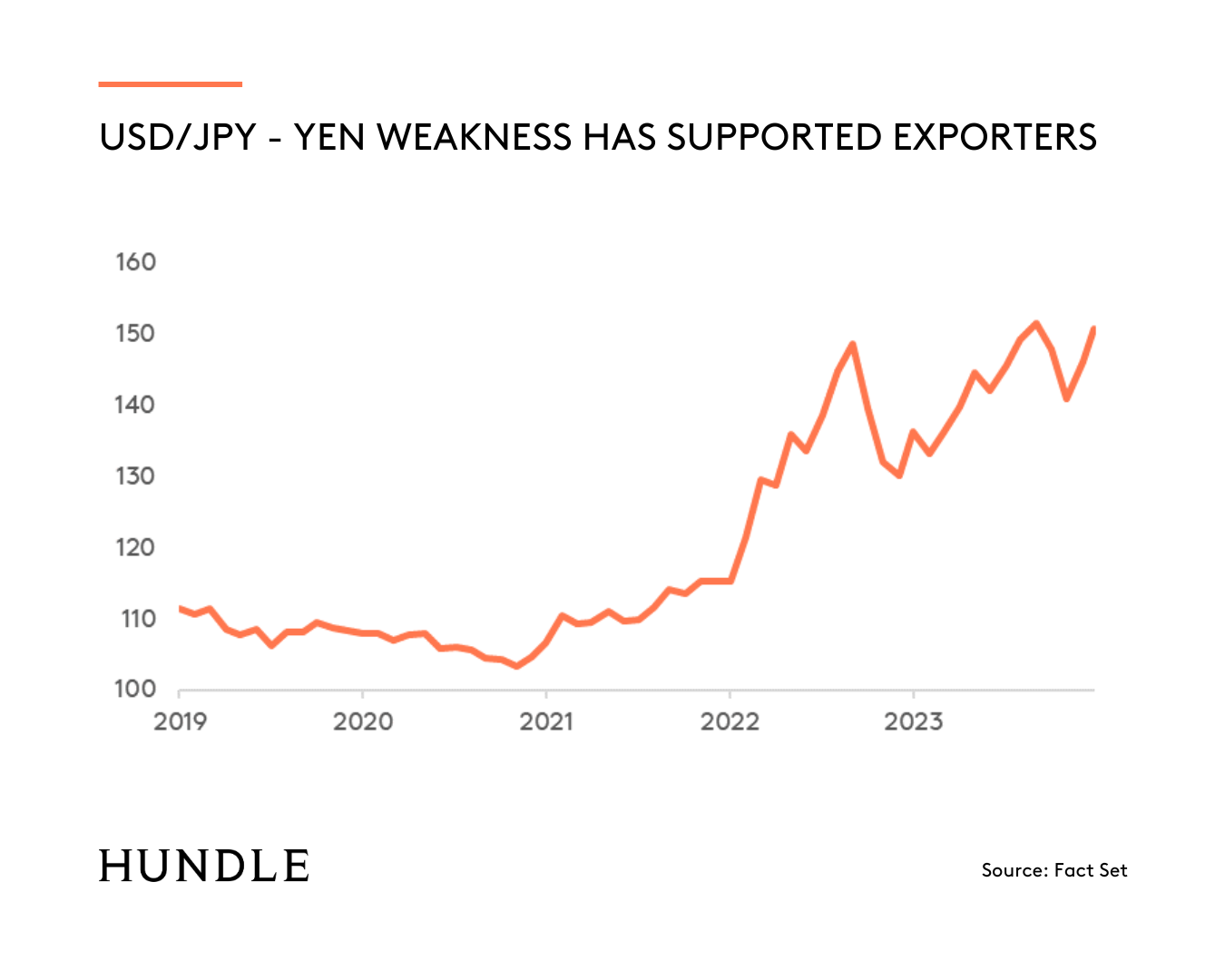

3. Stronger Yen: As monetary policy normalises, a stronger yen has the potential to hurt returns for investors in Japanese equities. That being said, the current cheapness of the yen means the appreciation would need to be very sharp before it undermined the competitiveness of corporate Japan or the attractiveness of Japanese equities for foreign buyers.

—

CONCLUSION

A lot has changed in the 34 years that have passed since the last Japanese equity market peak. The Imperial Palace is no longer worth as much as the state of California; global stock markets are dominated by the Magnificent Seven rather than Japanese banks; and the iPhone has supplanted the Game Boy.

As we look forward, our medium- and longer-term outlooks for Japanese equities remain positive, driven by improving corporate governance, an abundance of high-quality businesses trading at attractive valuations, and an improving economic picture. Volatility in Japanese stocks is certainly possible, however, in our view, this would be an excellent opportunity to add to our position.