Steering Through Uncertainty: Thoughts from Our CIO

28 April 2025

Sign up to our newsletter for regular insights from the Hundle team.

It has been a tumultuous start to the year that served as a stark reminder of how quickly sentiment can shift, and how thin the line can be between confidence and confusion. The headlines have moved fast – tariffs, trade wars, and tweets – and through it all, our core task remains unchanged: preserving and growing your capital in a prudent, thoughtful way.

LIBERATION DAY & THE GREAT REPRICING

Much has been said – and indeed, we’ve written at Hundle – about the impact of President Trump’s “Liberation Day” tariffs. These weren’t standard protectionist measures, but a broad, ideologically driven effort to remap global trade. The abrupt imposition of a 10% tariff on all imports sent markets into a tailspin, quickly followed by retaliatory measures from China, including steep duties and export restrictions on critical inputs.

Markets sold off sharply, and for good reason. These moves threatened to sever the economic ties between the world’s two largest economies, while also injecting fresh uncertainty into already fragile supply chains. Equities fell sharply. Volatility surged. Credit spreads widened. And yet, one could argue the market’s reaction was surprisingly restrained. That reflects not complacency, but confusion – an attempt by investors to separate political theatre from durable policy.

Of course, what followed hardly helped settle nerves. The initial tariffs were paused, then reinstated. Exemptions were announced and then revoked. Entire categories of goods were removed from the tariff list only to be added back later. The lack of any coherent or credible framework from the White House sent one clear message: this is policymaking on the fly.

A FRAGILE FAITH IN THE FED

In past crises, markets leaned on the central bank “put”. But that faith is eroding. Bond markets, typically a haven during stress, have not offered their usual comfort. Instead, we’ve seen simultaneous selling of US equities, Treasuries, and the dollar – an unambiguous signal that confidence in American financial leadership is being tested. This rare “triple unwind” is a sign of something deeper – concern not just about growth or inflation, but about institutional credibility itself.

President Trump has assured markets this week that Fed Chair Powell is safe – for now. Markets have reacted with tentative relief. But investors know this much: in 2025, political interference is not a tail risk. It is the baseline scenario.

THE ROLE OF GOLD IN PORTFOLIOS

Amid this uncertainty, gold has performed exactly as one might hope. Prices surged to a record $3,500 per ounce in April, driven by a potent combination of inflationary concerns, geopolitical instability, and growing doubts about central bank independence. Gold is not simply an asset – it’s a signal. When confidence in fiat currencies wavers and volatility strikes fixed income, gold often finds new strength

We hold gold in client portfolios as a hedge against exactly this type of environment – one marked by policy uncertainty, inflation surprises, and systemic mistrust. Its appeal is timeless, with no credit risk and no counterparty risk. Just intrinsic value in its most distilled form.

Physical demand remains robust, particularly in Asia and increasingly in Europe. Central banks continue to accumulate reserves, and investor inflows into gold-backed ETFs have accelerated significantly. Our view is that this is not a speculative spike – it reflects a strategic rotation into stability.

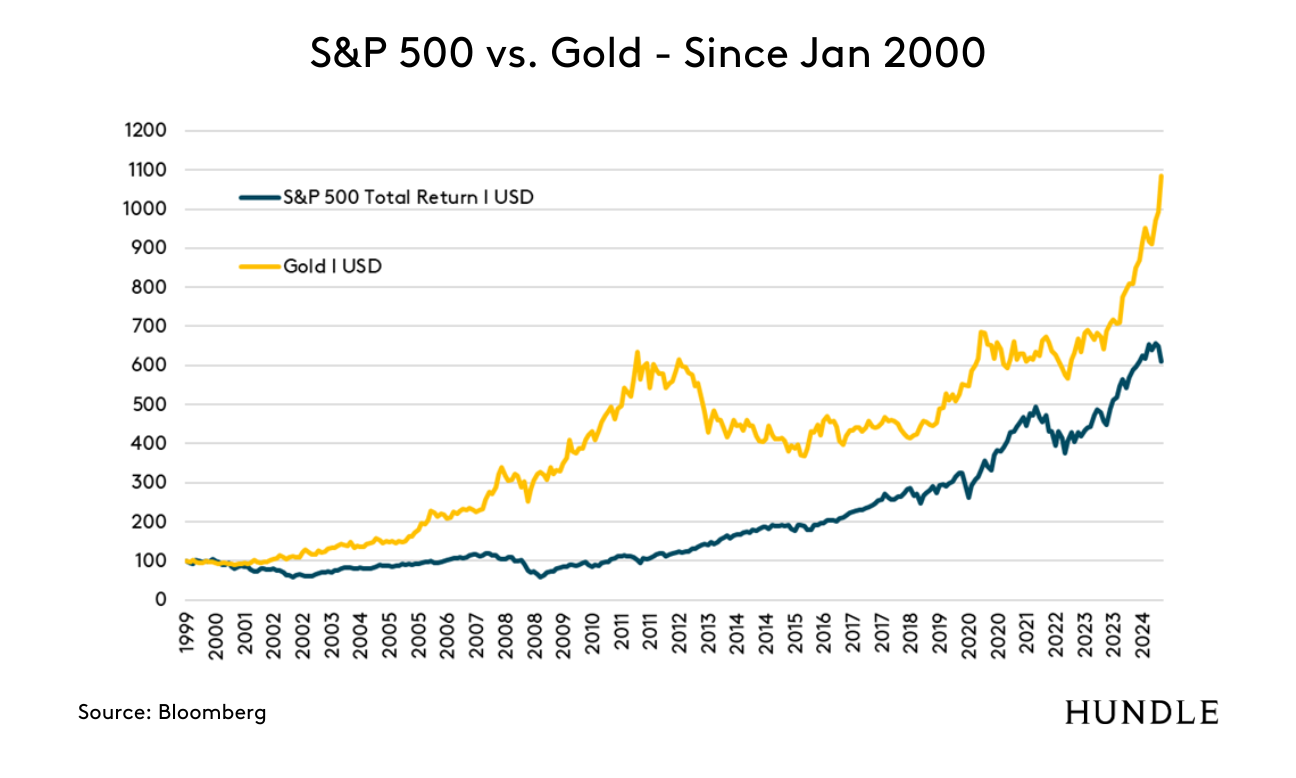

When comparing the long-term performance of Gold vs. the S&P 500 Total Return Index starting from 1 Jan 2000, it is surprising that a “non-productive” and “non-yielding” asset like gold has meaningfully outperformed the S&P 500 by a significant margin. While Gold can underperform for extended periods, e.g. recently from 2012 until 2023, Gold remains an asset that keeps its value in the long-run from a purchasing power perspective.

A DIFFERENT TYPE OF DIVERSIFICATION

This quarter underscored the limitations of traditional diversification. Equities and bonds fell in tandem, and many investors were left with fewer places to hide. Our philosophy remains unchanged: true diversification comes not from owning more of the same, but from owning structurally uncorrelated assets.

In addition to gold, we continue to favour asset-backed lending – loans secured by real, tangible collateral that provide equity-like returns with significantly lower volatility. These strategies have proven resilient, precisely when resilience matters most.

We are also exercising continued discipline with equity allocations. Despite recent declines, US valuations remain elevated. Until pricing better reflects macro risks and policy instability, we will maintain a cautious stance and retain our relative overweight to European equities.

LOOKING AHEAD: DISCIPLINE OVER DRAMA

If recent months have taught us anything, it’s that calm can be an illusion – and volatility the norm. As we look ahead, the backdrop remains anything but settled. What underpins it all is a deeper, more structural uncertainty – a growing sense that the old anchors of financial leadership and policy predictability are no longer quite so steady. For investors, the challenge is not to anticipate every twist, but to prepare robustly for a world where the signals are noisier and the cycles less smooth.

Our focus remains on preserving purchasing power, limiting drawdowns, and staying selectively opportunistic. Holding cash is not a sin. Owning gold is not an overreaction. And steering clear of crowded trades may be the wisest move of all.