First Take: The UK General Election

23 May 2024

Sign up to our newsletter for regular insights from the Hundle team.

The decision by Prime Minister Rishi Sunak to call an early election, rather than waiting until the Autumn, is a significant political gamble with his party trailing so far behind in the polls. However, ending the current uncertainty by giving voters a choice at the ballot box is in the nation’s best interest and could prove to be a catalyst for a more stable period in UK governance and stronger equity market performance.

—

THE POLITICAL LANDSCAPE

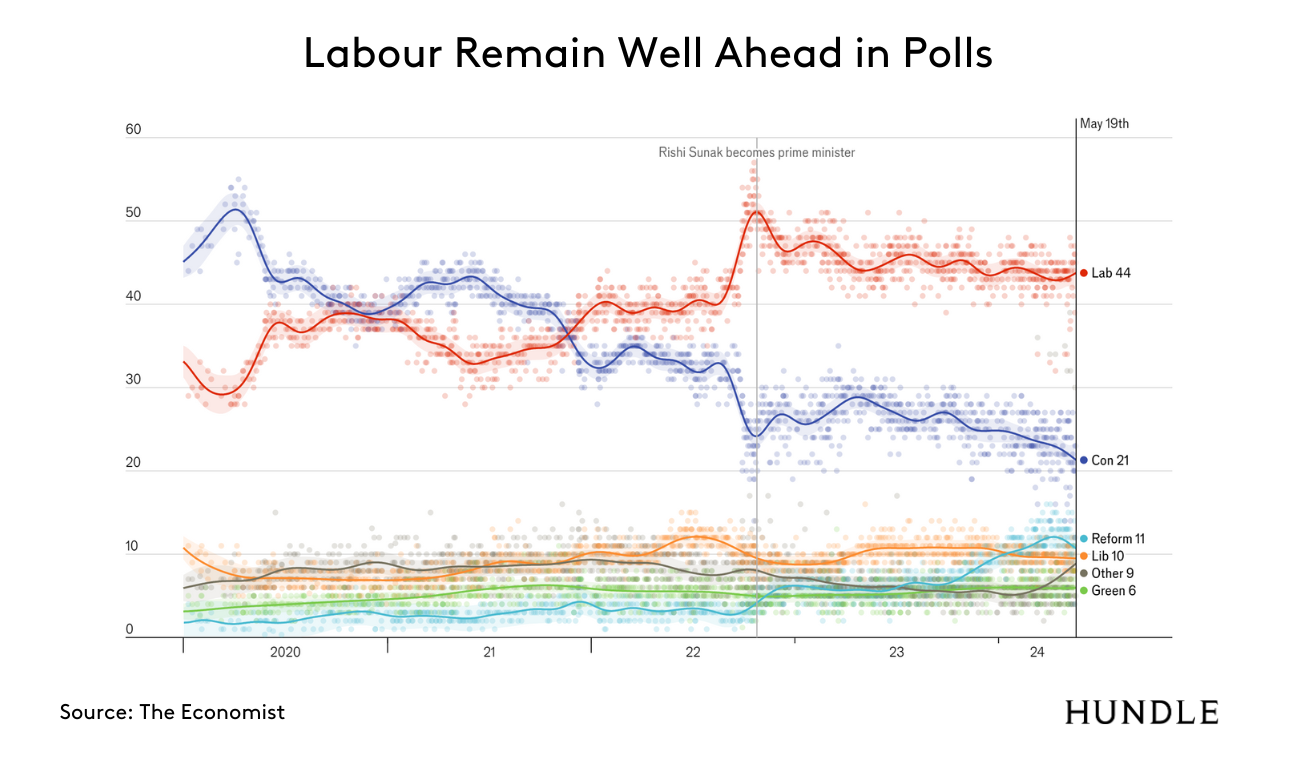

Polls currently show the opposition Labour Party with a commanding lead of over 20 percentage points. This gap has remained stable since the turmoil of October 2022 under Sunak’s predecessor, Liz Truss. Polls can be wrong, but with only six weeks to reverse this trend, Sunak faces an uphill battle unprecedented in modern British politics.

Sunak’s biggest challenge is that his party has a credibility problem when it comes to the economy. The mishandling of the economy during Truss’ brief tenure continues to undermine confidence in the current Conservative administration. YouGov polling on who voters ‘trust on the economy’ has shown a steady decline since Boris Johnson’s time as prime minister, which then accelerated dramatically under Truss. Sunak has failed to reverse this negative sentiment and time is running out.

A Labour government led by Keir Starmer is not seen as a major threat to the economy. Shadow Chancellor Rachel Reeves, a former Bank of England economist, is known for her cautious approach. The markets have made it clear, especially after the Truss episode, that they will not tolerate unfunded fiscal policies without regard for inflationary consequences. Starmer’s team have listened, and Labour’s proposed model suggests a steady, cautious, economic approach that will be welcomed by markets.

IT’S THE ECONOMY, STUPID

So, why has Sunak decided that now is the right time to call a vote?

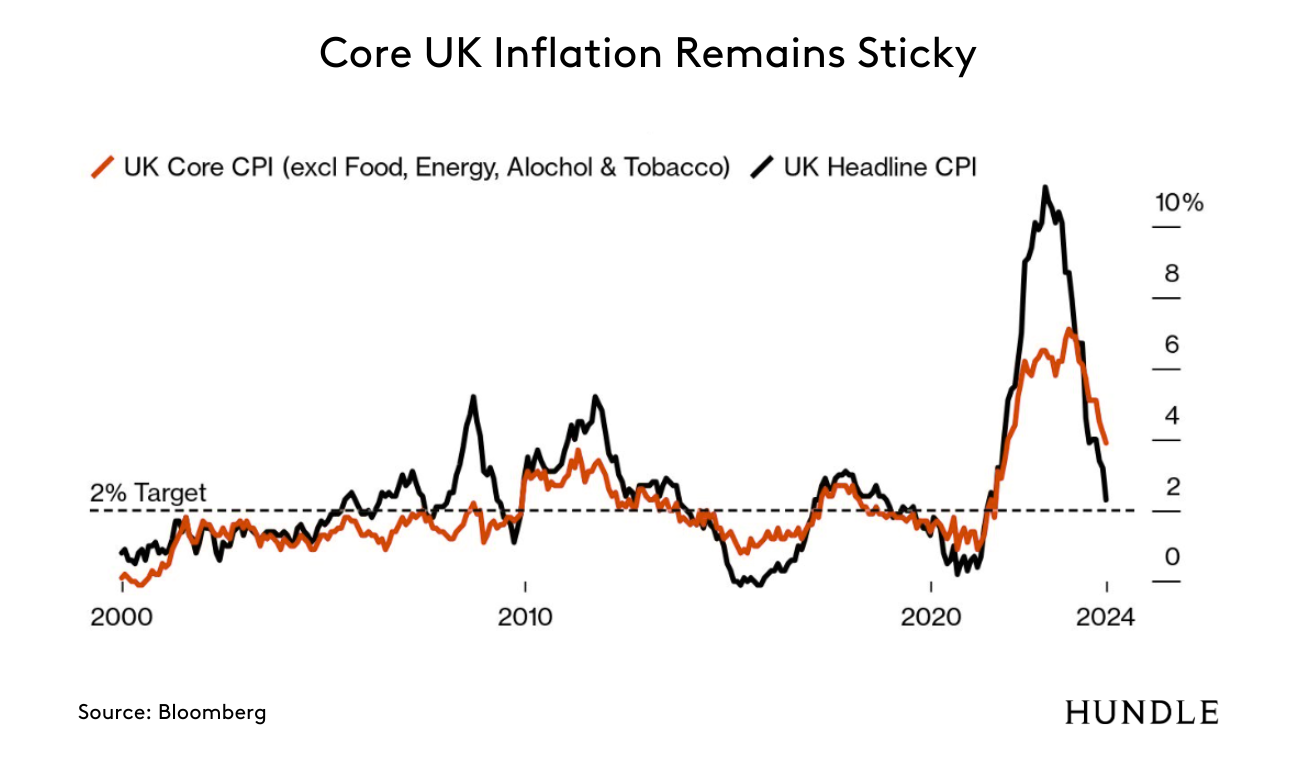

The economic picture in the UK has certainly improved in recent months. The economy grew by 0.6% in the first quarter of 2024 and real wages have grown for ten consecutive months. Crucially, headline inflation has dropped to 2.3%, close to the Bank of England’s target of 2%, which Sunak will look to exploit to make the argument that he has brought prices back under control.

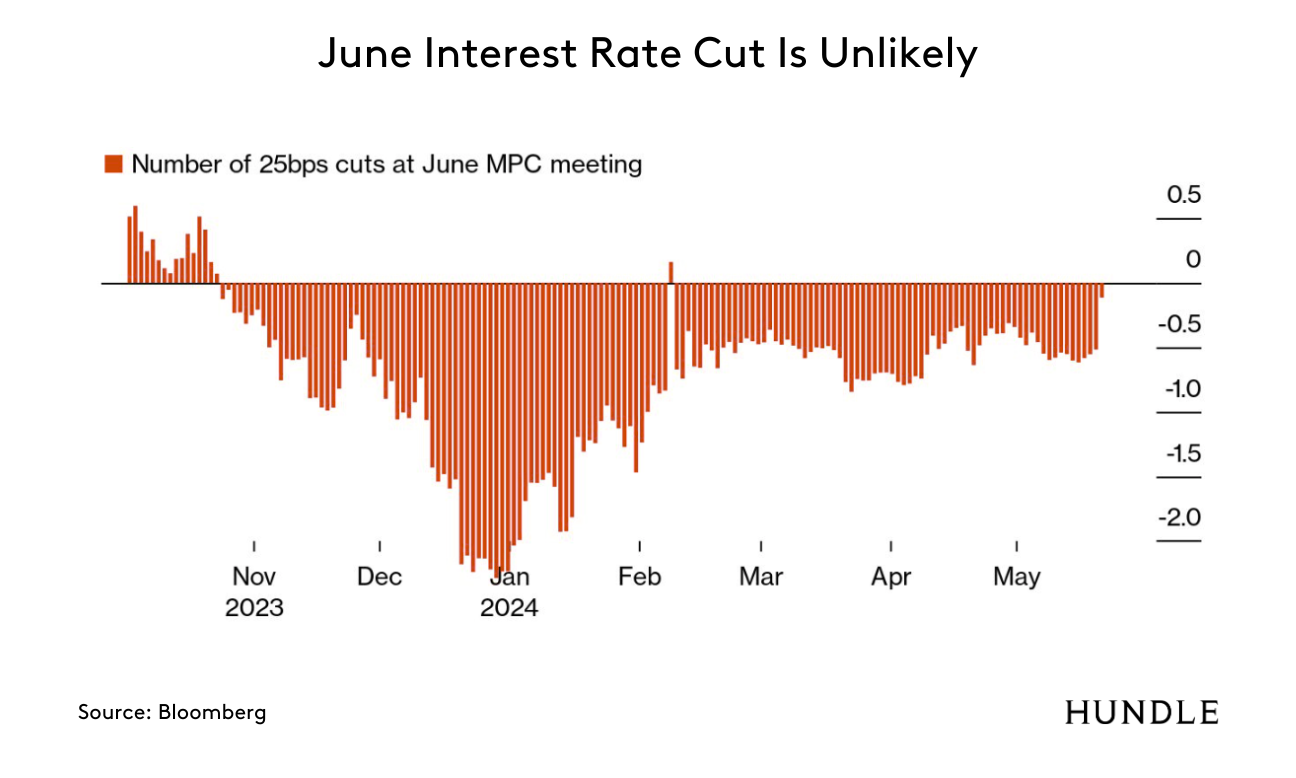

However, core inflation, excluding volatile items like food and energy, remains high at 3.9% and markets expect inflation to tick up in the next few months. This mixed inflation picture has reduced the likelihood of interest rate cuts by the Bank of England in the near term. Without the tailwind of falling rates, economic data is unlikely to improve later in the year. Moreover, the prospect of pre-election tax cuts now looks unlikely, and Jeremy Hunt has given up on the possibility of a further 2p cut in national insurance due to precarious public finances.

Ultimately, the Conservatives want credit from the public for returning the British economy to growth and ‘normal’ levels of inflation. Labour, meanwhile, want to blame Sunak for the volatility and soaring prices that happened on his watch. This debate will define the upcoming election campaign.

UK EQUITIES: THINGS CAN ONLY GET BETTER?

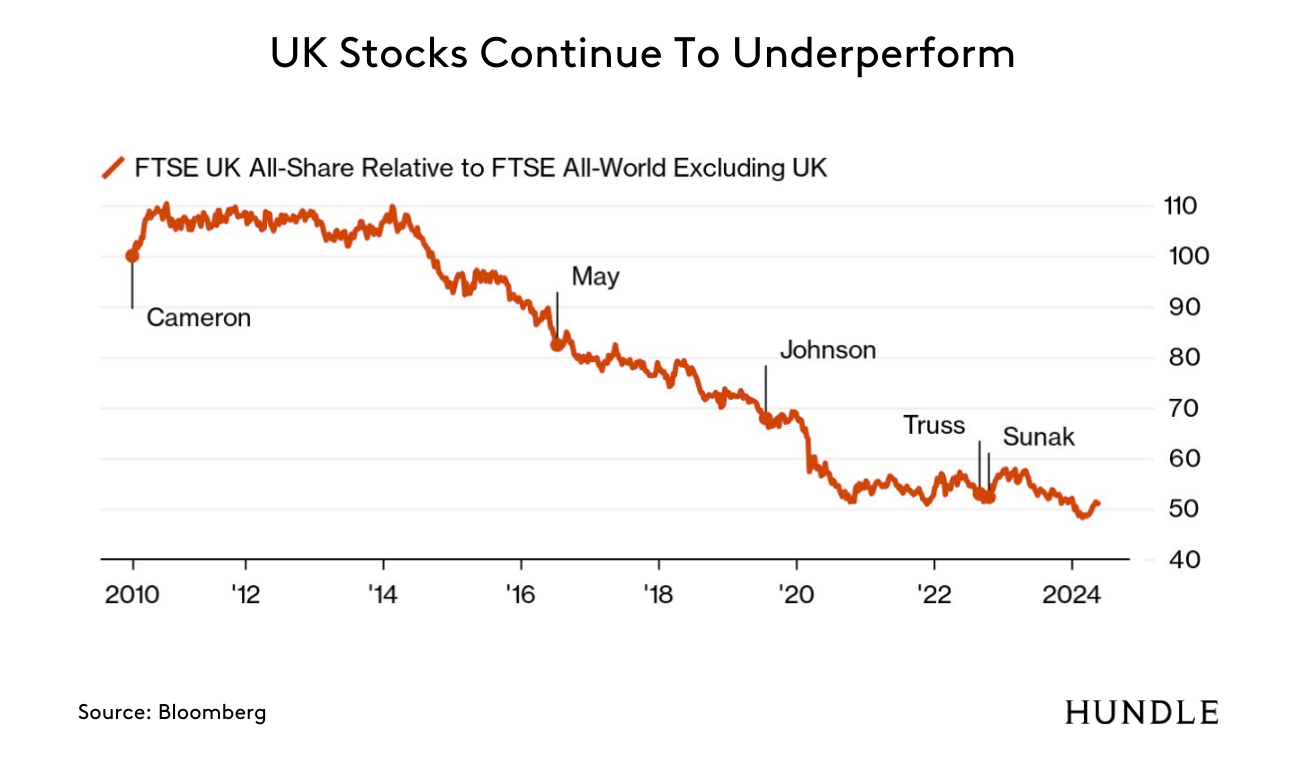

While Sunak can point to the UK stock market reaching new highs under his leadership, this will have limited impact on voter sentiment. British stocks have underperformed compared to global benchmarks, reflecting broader market scepticism. Investors remain wary; however, our view is that a change in government will be a positive for the FTSE. A much-needed period of political stability, combined with cheap relative valuations, makes UK equities an attractive home for global investors seeking to diversify away from expensive US stocks and political drama in both the US and Europe.

At the same time, we expect that the trend of international firms trying to acquire UK based businesses will continue and this will help to narrow the significant valuation gap that currently exists. Today’s news that Hargreaves Lansdown rejected a £4.67bn takeover approach from a group of private equity firms, including CVC Capital Partners, is just the latest sign of private equity’s growing interest in UK stocks trading at a discount.

THE PATH TO VICTORY

The key question is whether Labour can win in its own right or will be forced to form a coalition. Labour needs 326 seats for an outright majority in the 650-seat Parliament. Currently holding 205 seats, Labour faces a major challenge in gaining the additional seats required. Northern Ireland’s 18 seats and Scotland’s 59 seats add further complexity. The Scottish National Party (SNP) holds 43 of Scotland’s seats, however they are under severe political pressure and Labour has a golden opportunity to reestablish itself as a force in politics ‘north of the border’. Success in Scotland will be essential if Labour are to achieve an overall majority.

Much can happen in 6 weeks, and we will continue to provide regular updates as the election campaign evolves. We welcome the prospect of a more stable and predictable political outlook in the UK; however, any change comes with risk. Our team is always available if you would like to discuss the impact of a Labour government and how this might affect your business or personal circumstances.