Investment Update April 2024

1 May 2024

Sign up to our newsletter for regular insights from the Hundle team.

PRIVATE MARKETS

April was another positive month for our direct investments’ portfolio. We recently led an investment into Audoo, a music technology company that work with global music bodies to transform public performance royalty reporting using their patented technology, which ensures artists receive accurate distribution of payments for music played in commercial venues. During April, Audoo announced a partnership with IMRO (Irish Music Rights Organisation) which will see Audoo’s unique Audio Meter™, backed by the likes of Sir Elton John and ABBA’s Björn Ulvaeus, implemented as part of a trial programme in a selection of public spaces such as cafés, bars, restaurants, and retail locations across Ireland.

There was also encouraging news for F1 Arcade, who opened their first US site in Boston Seaport. Featuring 69 cutting-edge racing simulators and a leading food and drink offering, this new venue follows successful UK openings in both Birmingham and St Paul’s. We continue to be impressed with management’s performance, including profitability and sales at St Paul’s, execution of their business plan and their ability to develop a strong pipeline for international expansion.

EQUITIES

In April, global equity markets took a hit as US inflation came in higher than anticipated, dampening hopes for immediate interest rate cuts. This setback marked the first notable decline since the rally commenced in late October. Geopolitical tensions in the Middle East, paired with a mixed bag of Q1 earnings reports, added to the overall subdued market mood.

However, the UK market emerged as a standout performer, with both the FTSE 100 and FTSE All Share indices reaching fresh record highs. The UK’s inflation outlook brightened in March, alongside continued GDP improvement in February. We are seeing attractive opportunities in the UK due to low relative valuations and a more stable political outlook.

Mid-month, the S&P 500 and Nasdaq Composite indices dipped to two-month lows before seeing a partial recovery. US inflation surged to a six-month peak of 3.5%, surpassing expectations, while indicators like non-farm payrolls and the ADP private jobs report underscored ongoing tightness in the labour market, despite somewhat disappointing Q1 GDP figures.

Across the eurozone, inflation eased to a 28-month low of 2.4% in March, while there were positive trends in economic and consumer sentiment indicators and a noticeable uptick in PMI data. Germany skirted recession with a modest 0.2% growth in Q1 GDP.

Conversely, Japanese stocks faced headwinds from profit-taking and concerns over potential tightening measures by the Bank of Japan. Although headline inflation retreated slightly in March, the Bank of Japan warned of sustained wage pressures, citing settlements at multi-decade highs. While the Tankan Survey showed slight Q1 weakness, consumer confidence saw a mild uptick. We remain bullish on the medium-to-long term outlook for Japanese equities and see the normalisation of monetary policy as a significant tailwind.

Chinese equities experienced a modest upturn, with Q1 GDP slightly outpacing expectations and March inflation hitting 0.1%, marking the second consecutive month of positive inflation after a prolonged deflationary spell. While valuations of Chinese equities look very attractive, we continue to avoid direct Chinese exposure in client portfolios for now given concerns about geopolitical risks.

FIXED INCOME

Government bond markets saw significant weakening throughout April, marked by a notable surge in bond yields as the market recalibrated expectations for the timing of potential interest rate adjustments. Hopes for imminent rate reductions were dashed by the robust performance of the US economy and persistent inflation levels surpassing targeted benchmarks.

Many investors faced losses due to recent heavy positioning in long bonds, driven by significant bets on forthcoming rate cuts, a scenario which now seems less likely. Currently, Fed fund futures indicate expectations of one to two rate cuts, amounting to a range of 25 to 50 basis points, a stark decrease from earlier projections of six cuts totalling 150 basis points.

Comparatively, both the European Central Bank and the Bank of England have taken a relatively more dovish stance compared to the Federal Reserve. This has spurred speculation that either the ECB or BoE, or possibly both, may implement rate cuts before the Federal Reserve, potentially during the latter half of the summer. Such expectations have contributed to the depreciation of the euro and sterling against the dollar.

The Bank of Japan has hinted at future tightening measures, citing concerns over wage settlements potentially fuelling higher inflation rates down the road, compounded by the yen’s depreciation, which could exacerbate imported inflation. Notably, the two-year Japanese Government Bond (JGB) reached a 15-year high amidst these developments.

COMMODITIES

The CRB Commodity Index saw a modest uptick in April. Worries about escalating tensions in the Middle East, notably Iran’s drone attack on Israel, caused oil to spike higher. The determination of OPEC + to keep production levels tight also underpinned oil. However, rumors of peace negotiations between Hamas and Israel saw oil prices fall late in the month.

Copper climbed to a two-year high on the back of improved economic indicators from China and ongoing concerns about supply-side constraints, particularly evident in Chile.

Aluminium and nickel also gained value, partly due to regulatory measures implemented by the US and UK, restricting trading of Russian-origin supplies on exchanges like the Chicago Mercantile Exchange (CME) and the London Metal Exchange (LME). This regulatory action extends to copper as well.

Gold witnessed a robust rally, surpassing $2400 per ounce and setting a new record peak. Notably, certain central banks, including China’s, have significantly bolstered their gold reserves recently, reflecting strategic efforts to replenish reserves. We are actively assessing the role of gold in client portfolios as a source of diversification.

CURRENCIES

The US dollar index hit a five-month high as currency traders discounted the likelihood of the Federal Reserve delaying rate cuts until later in the year. Sterling depreciated against the US dollar, reaching a four-month low mid-month before experiencing a partial recovery. The euro declined to a two-month low mid-month, partly attributed to rising expectations of ECB rate cuts preceding those of the Federal Reserve. However, it concluded the period with a modest uptick.

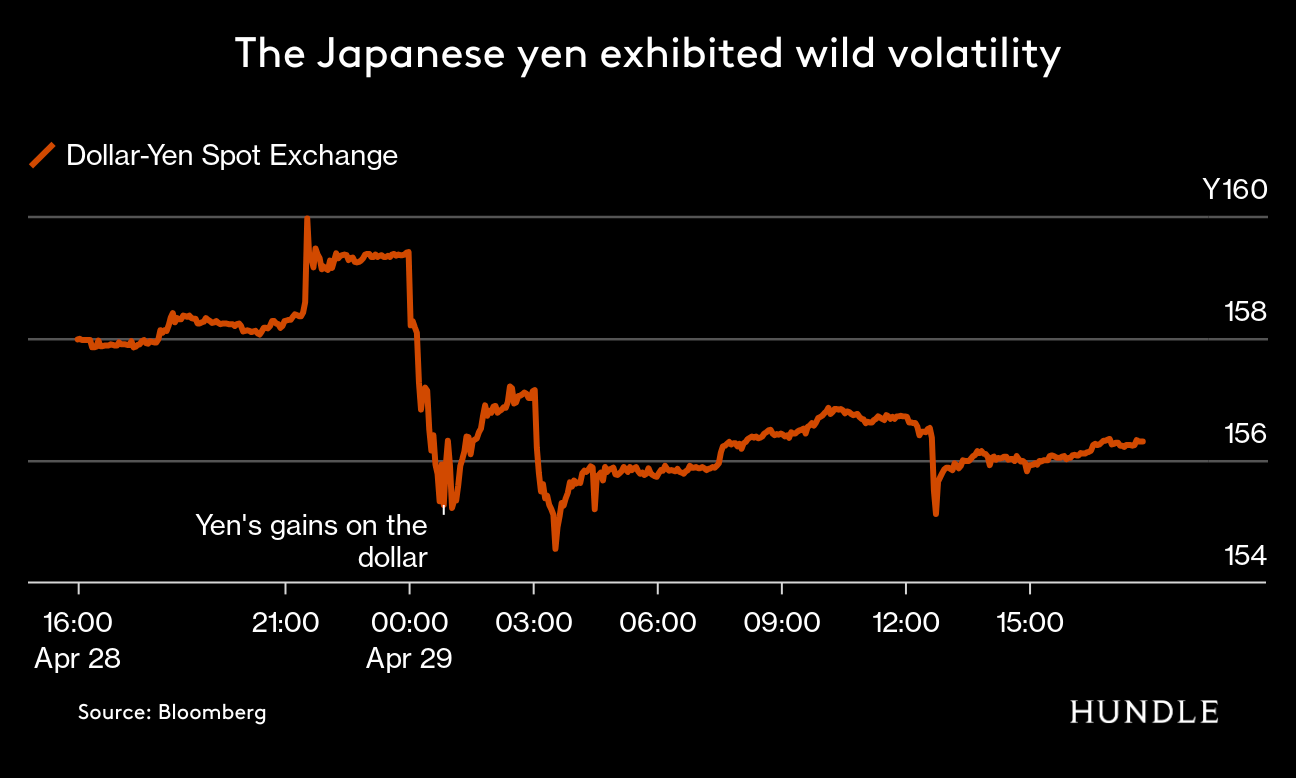

The Japanese yen exhibited significant volatility, persisting in its depreciation despite the Bank of Japan’s rate increase and warnings of intervention to support the currency. It depreciated to over 160 against the USD, marking its lowest level since 1990, and also declined to a 31-year low against the yuan. However, rumours of Bank of Japan intervention facilitated a recovery to the range of 155-156.

The Chinese yuan depreciated to a five-month low against the US dollar before ultimately concluding the month with marginal change.