Trump 2.0: The Race For The White House

9 February 2024

Sign up to our newsletter for regular insights from the Hundle team.

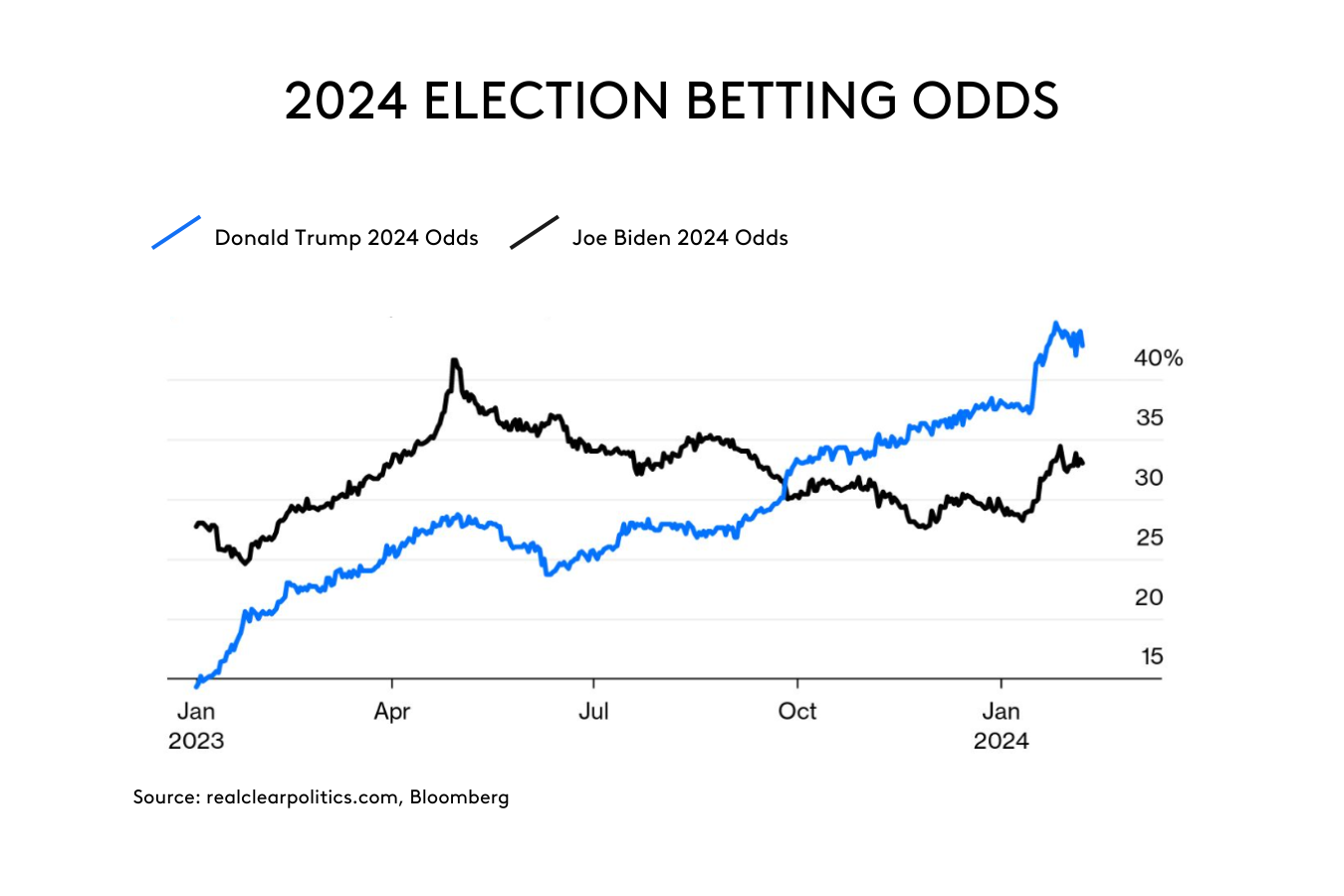

HOW LIKELY IS A TRUMP PRESIDENCY?

Things change very quickly in politics. Rewind to the start of 2023, and most commentators had written off the possibility of a Trump return due to legal challenges and the rise of Ron DeSantis. Today, Donald Trump is riding high, having dominated the early stages of the Republican party nomination process. Polls pitting Trump vs. Joe Biden are neck and neck. Trump’s chances have been boosted by the Department of Justice’s investigation released on Friday into Biden’s handling of sensitive material, which cast the US president as a “well-meaning, elderly man with a poor memory.”

A lot can happen between now and the start of the election, however our base case is that a second Trump term is more likely than not. The obvious risk to that scenario is the possibility of Trump being barred from running by the US Supreme Court or a criminal conviction being confirmed ahead of the election from the State of Georgia. The stakes could not be higher for America’s highest court – a 6-3 conservative majority should work in Trump’s favour, but the prospect of Trump being removed from the race, or even jailed, should not be entirely discounted and is the biggest impediment to his success.

IT’S THE ECONOMY, STUPID

Over the past year, the US economy has defied gloomy expectations. The labour market remains robust; inflation has cooled; and growth has moderated in a manageable fashion. Recent data remains supportive of a ‘soft landing’ outcome, as the US added a stunning 350,000 new jobs in January, which blew expectations out of the water. This is arguably the strongest US labour market since the 1960s, which has fed through into improving consumer confidence. In an ordinary election, these economic conditions would make Biden the clear favourite. But there are several factors that make us think that this time could be different.

Firstly, we would challenge the popular narrative that the Federal Reserve will do everything it can to support the Biden campaign by aggressively cutting interest rates over the next 9 months. Yes, a Biden administration would undoubtedly be the preferred option for Jay Powell, however the Fed have made it clear that the markets are overestimating the number of cuts in 2024. The Fed must protect their independence at all costs, and the danger of this being called into question could actually force them in a more hawkish direction. Moreover, the impact (either positive or negative) from changes to monetary policy tend to show up with a lag. Any cuts between now and November are more likely to benefit Wall Street than Main Street.

That being said, the economy and financial markets could still play a decisive role in shaping the outcome of the US election. A spike in gas prices caused by an escalation in Russia or the Middle East would hurt US consumer confidence. In a similar manner, a severe stock market correction would hurt Biden. Stock ownership by US households is nearing record levels, at a time when equity valuations look stretched. As was the case with John McCain in 2008, a painful market crash prior to the election would decimate Biden’s chances of election success.

At the very least, we also anticipate that social issues will play an equally important role in dictating the outcome of the election. Biden and Trump could not be more divided over key issues such as migration, the environment, and abortion. US public opinion has never been more polarised, and our fear is that this election will only serve to entrench views.

—

PRESIDENT TRUMP

Trump has already stated that he would remove Jerome Powell as Fed chair if he wins in November. Powell has (belatedly) done a good job of navigating the tricky task of bringing inflation under control, while avoiding a crash landing for the economy. Removing him from office would shake the confidence of financial markets, and risk politicising monetary policy. If investors start to question the independence of the Federal Reserve, this will have significant ramifications for Treasuries and the US dollar. We expect that the risk of a bond market rout would be enough to deter Trump from trying to overtly seize control of monetary policy, but this scenario is not beyond the realms of possibilities.

On the fiscal side, Trump will bring back a version of his 2016 playbook of tax cuts and de-regulation. This could be supportive of the stock market in the short-run, however fiscal headroom is much tighter than it was during Trump’s first term which will limit his ability to enact material changes. Equally, it is unlikely that Trump will have complete control over Congress, which will serve as a brake on his ambitions for lower taxes and less red tape.

The other key consideration is the geopolitical impact of a Trump presidency. The world is in a less stable position that it was during his first term. The Russia-Ukraine war; the threat of an escalation in the Middle East; and tensions with China are all live risks which could threaten global stability. It remains to be seen how Trump would navigate these challenges, but his unconventional approach towards geopolitics will increase the likelihood of something going badly wrong.

MARKET IMPACT

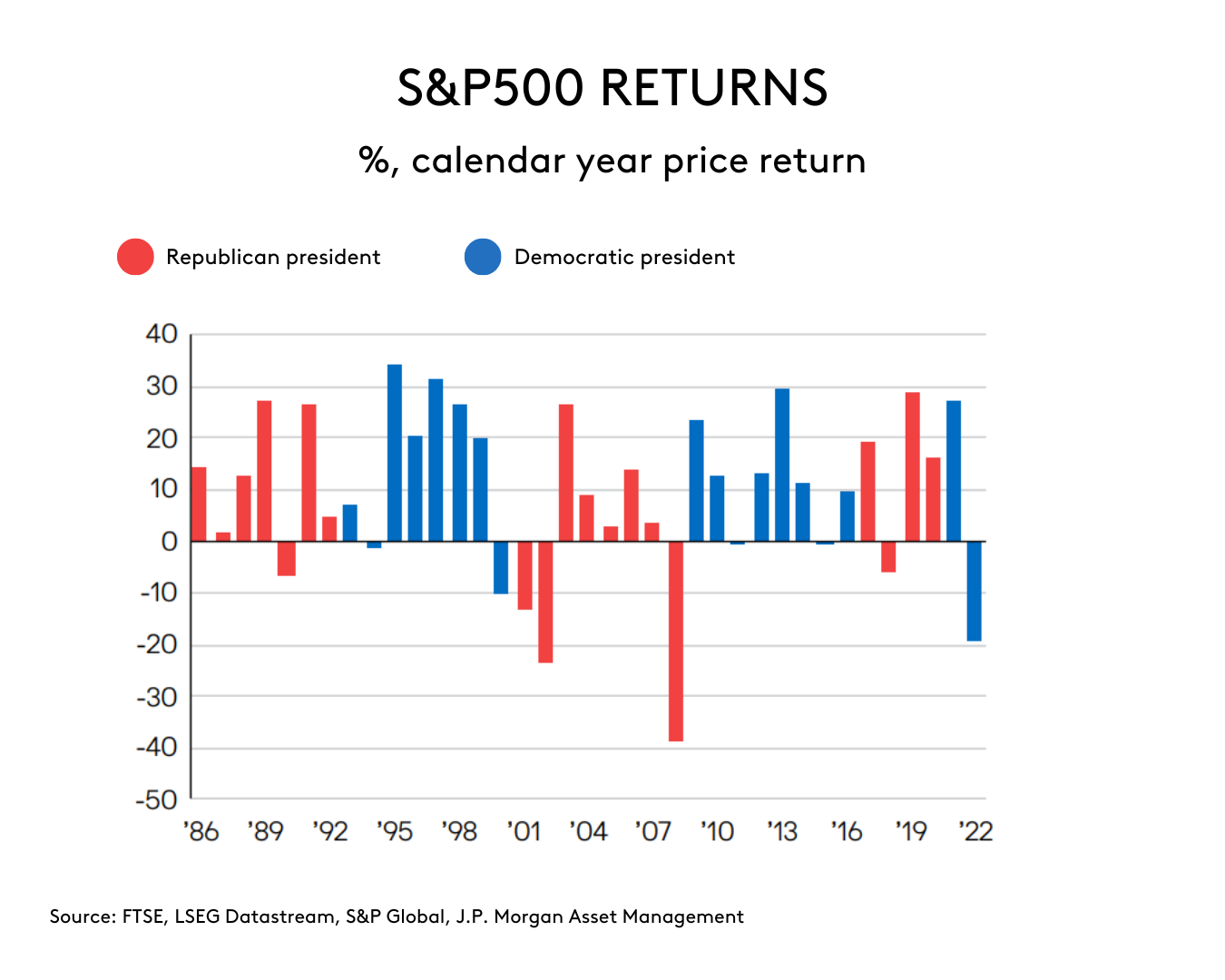

Predicting the outcome of a general election, particularly one as close as we expect in the US, is fraught with danger. Predicting the subsequent stock market winners is even more challenging.

Since Biden was elected in 2020, large-cap US Oil & Gas stocks have risen 230%, while the Nasdaq Green Energy Index has fallen by 27%. This is despite Biden’s ambitious clean energy agenda. In contrast, clean energy stocks rallied under Trump at a time when he pulled the US out of the Paris Climate Agreement.

Outside of stocks, it is not entirely clear whether Trump’s economic policies will be positive or negative for the US dollar. Our view is that a Trump win would initially see the dollar strengthen, however this would be a product of weakness in other major currencies in response to Trumpian trade policy.

Without doubt the 2024 US election will be one of the most consequential political events in living memory. Despite the magnitude, we are careful to resist the temptation to alter client portfolios materially in anticipation of unpredictable political events.

As noted above, the unreliability of polling data makes predicting the outcome of elections extremely difficult. Even if we were certain about the result, it is another matter entirely to understand which campaign promises will actually become a reality and, in turn, how this would play-out in the stock or bond market. And finally, it is important to note that there is no clear long-term correlation between which governing party is in power and the performance of the US stock market. The old assumption that a Republican presidency is good for equities is no longer accurate.

We believe that the best hedge is to construct well diversified ‘all-weather’ portfolios, that have the ability to deliver consistent returns for our clients no matter the political outcome. At the same time, our investment team will seek out short-term opportunities which will undoubtedly emerge due to increased volatility around the election.