December Market Outlook

13 December 2024

Sign up to our newsletter for regular insights from the Hundle team.

WHAT’S BEEN HAPPENING IN MARKETS?

US equity markets responded strongly to Trump’s presidential victory, buoyed by expectations of pro-growth policies including tax cuts, fiscal expansion, and a more nationalist trade stance. This optimism drove small-cap stocks, seen as primary beneficiaries, to an 11% gain in November, significantly contributing to the MSCI World Small Cap Index’s 7% return. Growth stocks slightly outpaced value stocks, though the healthcare sector struggled amid concerns over the new administration’s stance on pharmaceuticals. Meanwhile, global equities delivered a 3.8% gain, but emerging markets lagged as fears of US trade conflicts weighed on Chinese equities.

The US dollar saw its strongest consecutive monthly gains in over two years, driven by expectations that Trump’s fiscal policies might stoke inflation and cut short the Federal Reserve’s rate-cutting cycle. While this dollar strength pressured global bonds in USD terms, commodities saw mixed performance, with rising gas prices offsetting declines in precious metals due to concerns over Russian supply and unexpected production disruptions in Australia.

THE US CONSUMER REMAINS POSITIVE…

Over the past two years, the strong performance of US equities has been underpinned by a robust recovery in corporate earnings since the challenging period of late 2022. However, in certain parts of the market, share prices have risen even faster than earnings growth, driving valuations to record levels. These elevated valuations reflect high expectations for future earnings growth, partly driven by optimism surrounding the potential of artificial intelligence and a broader confidence in the resilience of the US economy.

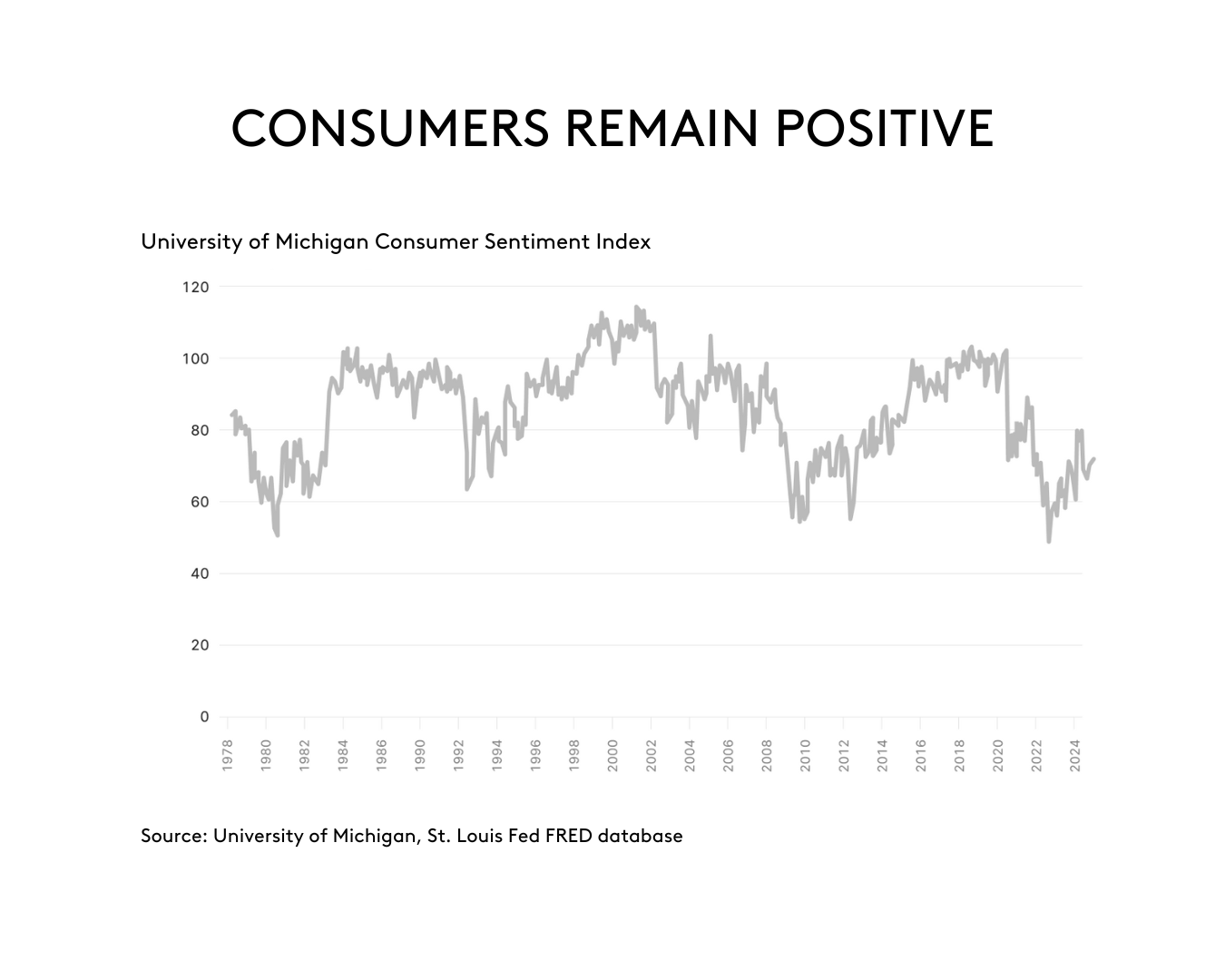

Consumer sentiment offers valuable insight into this confidence. While the path has been uneven—reflecting economic uncertainty, inflationary pressures, and Federal Reserve interest rate hikes—there has been a marked improvement from the low point in June 2022, when inflation peaked at 9%. The University of Michigan’s Consumer Sentiment Index, for example, has shown significant recovery, with the latest readings indicating gains in confidence following the recent election. Similarly, the Conference Board’s Consumer Confidence Index for November reached its highest levels in two years, and the proportion of consumers expecting a recession over the next 12 months has fallen to its lowest since mid-2022.

Interestingly, optimism about the stock market has also surged, with over half of consumers now expecting share prices to rise in the coming year—a record high for this measure.

HOWEVER, INFLATION CONCERNS PERSIST…

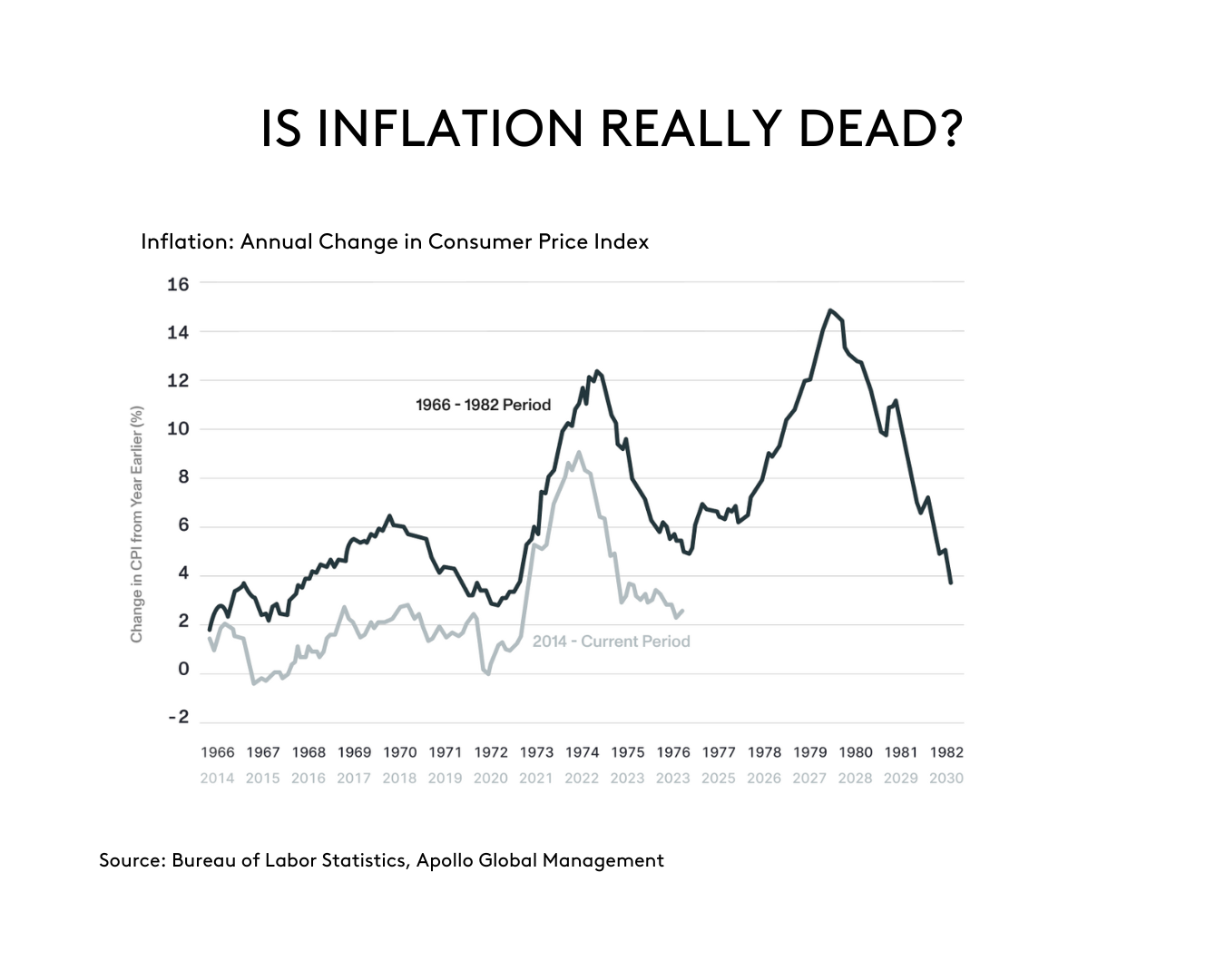

Despite this positive sentiment, inflation remains a key concern. Recent progress in reducing inflation towards the Federal Reserve’s 2% target has slowed, and there are lingering risks of a resurgence. Some commentators have drawn parallels with the inflationary cycle of the 1970s, where initial success in controlling inflation was followed by a second wave before the issue was ultimately subdued through aggressive monetary policy.

That said, there are important differences between now and the 1970s. Inflation levels today are notably lower, and the Federal Reserve has the benefit of hindsight, having learned valuable lessons from the past. Policymakers are acutely aware of the risks of prematurely loosening monetary policy before inflation is firmly under control.

WHAT DOES THIS MEAN FOR HUNDLE PORTFOLIOS?

We remain vigilant about the risks of inflationary pressures re-emerging. Factors such as rising energy prices, tightening labour markets, and the Fed loosening monetary policy at the same time government spending remains expansionary, could all combine to create a “second wave” of inflation. Equity markets currently seem to discount this possibility, which is part of the reason why we remain underweight US equities in client portfolios.

We continue to position portfolios conservatively, balancing the opportunities presented by resilient economic sentiment with the risks posed by inflation and potential policy missteps. Recent additions include gold, which is likely to be a beneficiary of increased inflation volatility and ongoing financial repression in developed markets. Given gold’s strong performance, we have started with a small allocation and will look to build the position opportunistically.

If you have any questions about your portfolio or would like to discuss these updates in more detail, please don’t hesitate to reach out.