Market Update January 2024

2 February 2024

Sign up to our newsletter for regular insights from the Hundle team.

After the market euphoria which characterised the final quarter of 2023, January was more of a mixed-bag for investors. US equities initially hit a record-high on the back of a resilient economy, before slipping back in response to hawkish comments from the Federal Reserve at the end of the month. The Fed’s stance also made it a tough environment for fixed income and real estate assets.

US

The US equity market started the year in a bullish mood. The S&P 500 hit a record high in response to the increased probability of a ‘soft’ economic landing. Based on the earnings yield of the index, US stocks have never looked more expensive relative to European stocks.

The US economy continued to shrug-off the impact of higher interest rates and fears about a recession. In early January, the Bureau of Labor Statistics reported that the US economy had added 216,000 jobs in the prior month and unemployment had remained at just 3.7%. This was followed by a bumper 353,000 new jobs in January, which was well ahead of expectations. The strong labour market fed through into an an above-consensus fourth quarter GDP print of 3.3% which capped off a strong 2023.

In Big Tech, Microsoft, Amazon and Apple all reported impressive quarterly results, while Meta (the owner of Facebook and Instagram) announced their first-ever dividend and a $50bn share buyback which sent shares up nearly 20% in response. This was the largest one-day gain in value for any company ever. Alphabet (the parent company of Google) lagged behind after it narrowly missed forecasts for growth in its advertising business. Likewise, Tesla warned that 2024 sales would be “notably lower” and the electric-car maker was “between two major growth waves.” It appears that investors have started to differentiate between members of the ‘Seven’ and assess carefully exactly which ones will reap the most benefits from artificial intelligence.

The S&P did reverse some of its gains at the end of month. The sell-off was caused by the hawkish tone adopted by the Federal Reserve at their January 31 meeting. Jay Powell poured cold water on the possibility of an interest rate cut in March and suggested that markets were too optimistic about the path of rates.

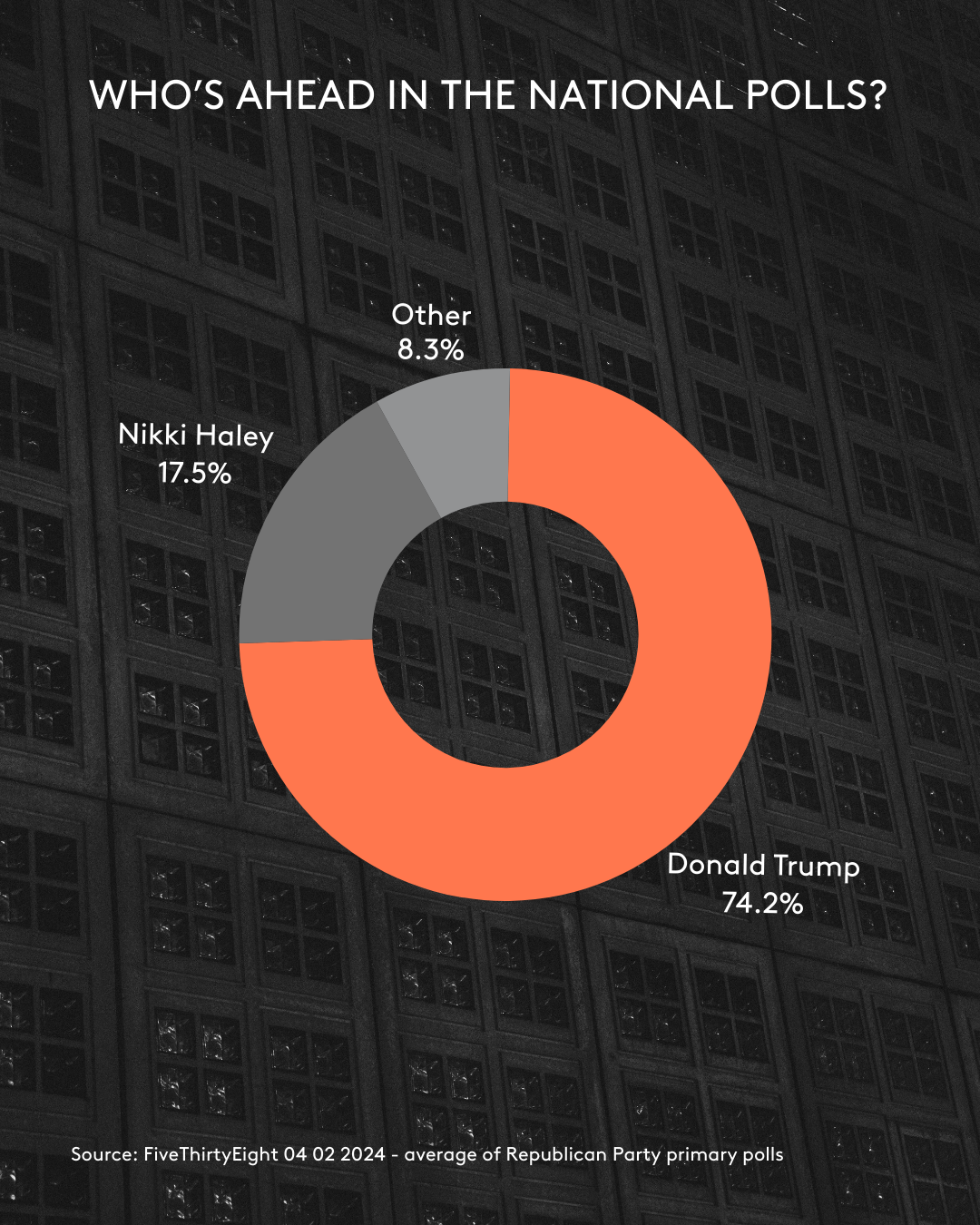

Turning to politics, Donald Trump emerged victorious from the Republican primaries in Iowa and New Hampshire. This has solidified expectations of a Trump vs. Biden rematch in November’s US election. There is potential for significant market volatility given the disparities that exist between the two likely candidates, particularly around taxation, regulation, trade, the environment and geopolitics. Our working assumption is that the election will be close and we are therefore carefully considering the market impact of both a Trump and Biden administration.

EUROPE

European equities enjoyed a positive start to the year. The MSCI Europe ex-UK index climbed 2.1% for the month, adding to an impressive 17.3% return in 2023. European high-yield bond markets were a notable positive outlier in what was otherwise a challenging month for fixed income assets.

European Central Bank president Christine Lagarde said rapid wage growth was already showing signs of slowing in the eurozone, and struck a dovish note on the potential for interest rate cuts even as the ECB kept monetary policy on hold.

UK stocks underperformed and the FTSE-All-Share declined 1.3%. The UK economic picture was mixed, with disappointing retail sales partially offset by better than expected consumer confidence, house price and PMI data.

The Bank of England held borrowing costs at 5.25% and opened the door to interest rate cuts but said it first required “more evidence” that inflation would continue falling. Gilts were the weakest performing major government bond market in January, which suggests that bond investors are sceptical about the possibility of near term interest rate cuts.

In January, the IMF predicted the UK economy will expand by just 0.6% in 2024, the second-slowest pace in the G7 after Germany and little better than the 0.5% estimated for 2023. UK gross domestic product growth is forecast to accelerate to 1.6% in 2025.

—

ASIA

The Japanese TOPIX index was the best performing major equity market in January. The 7.8% return for the month added to the 28.3% return in 2023. This performance was driven by positive sentiment towards the Tokyo Stock Exchange’s corporate governance reforms. The stock exchange has incentivised listed companies to boost valuations and earnings, and companies could potentially be delisted if they are unable to show they are using their capital efficiently. This should result in the unwinding of Japanese companies’ cross-shareholdings — shares that firms own in their business partners to maintain those relationships — which will boost valuations and shareholder returns.

More broadly, Asia-ex Japan and emerging markets faltered due to concerns about the Chinese domestic economy. January saw weak retail sales and further slowing in housing activity. Q4 Chinese GDP came in at 5.2%, which was widely expected but still disappointing. In response, the People’s Bank of China announced a raft of stimulus measures, however investors were left underwhelmed. The CSI 300 equity index has fallen more than a fifth in the past year, while the value of new home sales among the country’s biggest developers in December was down 35% from a year earlier.

On January 13, Taiwan voted for Lai Ching-te to be its next president. This result marked a historic third term in power for the pro-sovereignty Democratic Progressive party who have promoted a sovereign Taiwan and a national identity separate to China. In the run-up to the vote, the Chinese Communist party warned Taiwan’s voters to make the “right choice” between peace and war, however their subsequent reaction has been reassuringly muted.

—

COMMODITIES

The Bloomberg Commodity index rose 0.4%, following a 7.9% decline in 2023.

Gold prices remained above $2,000 per troy ounce due to increased buying from central banks and strong demand from Chinese retail investors. Central bank buying was led by China, Poland and Singapore, however more than half of all central bank purchases were attributed to ‘mystery’ buyers who chose to conceal their identify from the IMF.

Oil prices surged in January due to geopolitical issues such as the war in Ukraine, heightened tensions in the Middle East, and shipping disruption in the Red Sea. The International Energy Agency warned of volatile gas prices this year, with conflict in the Middle East and Ukraine creating “an unusually wide range of uncertainty” in its forecasts.

—

OUTLOOK

We remain cautiously optimistic about the outlook for risk assets in 2024. To date, the global economy has weathered the effects of high inflation and high interest rates remarkably well. Engineering a return to low inflation without a recession is notoriously difficult, especially against a background of elevated geopolitical risk. However, the possibility of a soft economic landing has certainly increased.

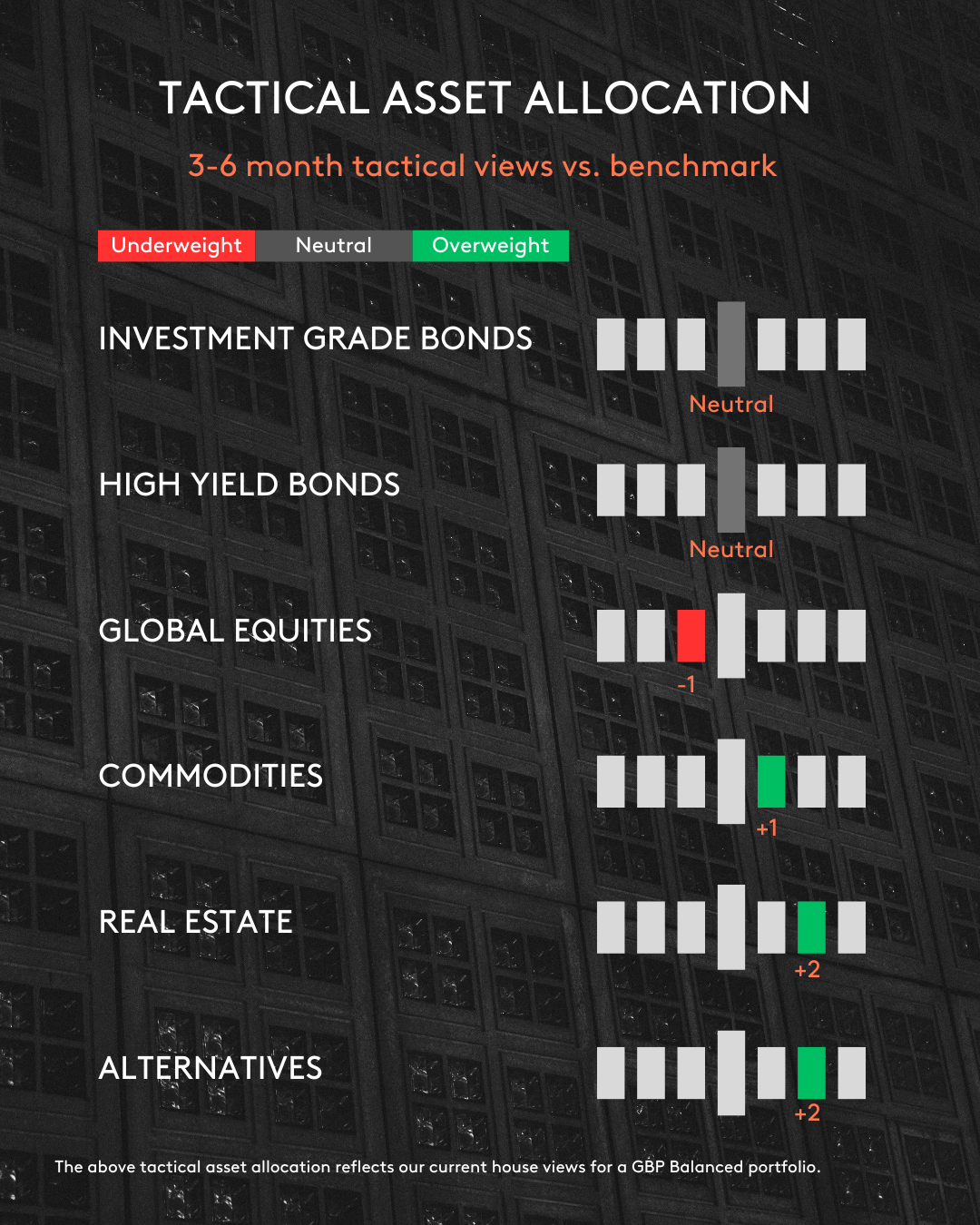

In response, we have been gradually reducing our underweight to equities, with a preference for geographic regions and sectors which offer a more attractive entry point from a valuation perspective. We are seeing pockets of value in US midcaps and UK equities, and are currently assessing opportunities in Emerging Markets. In fixed income, we have been cautiously adding to duration but are mindful of how far rates have moved in recent months.